August numbers are in, and the prevailing trends remain strong:

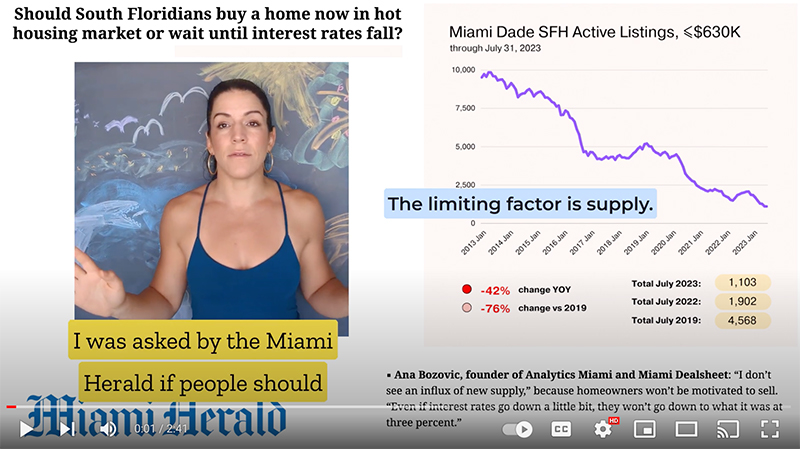

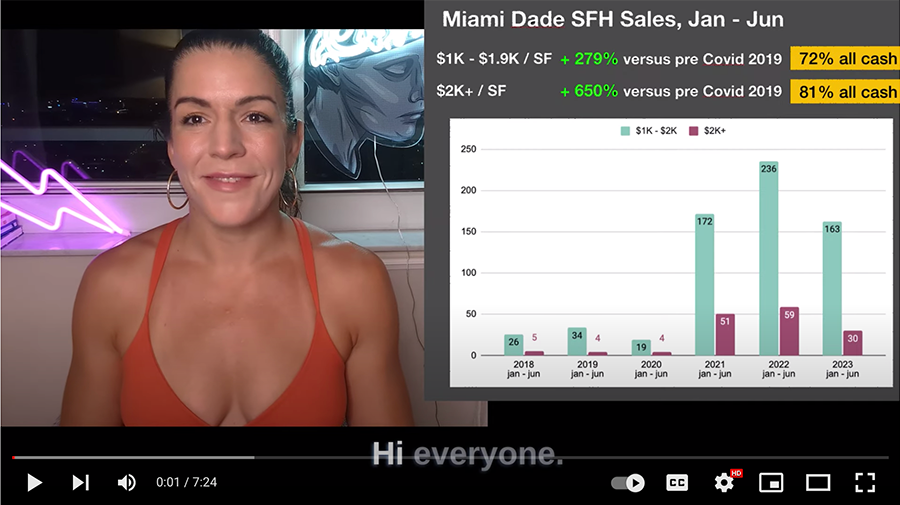

1) For purposes of discussion, we have two markets: the very high and and everything else.

--> August sales volume of SFH past $1K / SF was higher than last year, despite overall volume drops. (Contact me for on & off market opportunities & buildable lots)

2) Data quantifying macro trends pushing high value domestic migrants keeps coming in.

It is my belief that forces pushing high net worth domestic migration are still in their infancy.

Real Estate Investing: Finding Returns In A Low Yield Environment

Questions I often get asked by individual investors:

Where should I put my money?

Where can I get a good return?

And are there any opportunities in the market now?

Option A: Miami Condos

Some of the people asking me about investments have owned in condos here in Miami. As it stands right now, the Miami condo market has two disturbing trends: condo transaction volume keeps dropping and aggregate value of condo inventory keeps rising.

Until these trends reverse, I cannot recommend that individual Miami condos be purchased purely as investments.

The only real opportunity to profit off of condos is by purchasing near the bottom of the cycle or very early in an uptrend. Miami real estate is still very volatile, and you can make money by waiting for compelling prices and net cap rates. Condos have significant carrying costs (maintenance and property taxes), are not very liquid, and have high transaction costs. So you really have to make sure you are getting in near the bottom to justify holding them.

Option B: REITS

REITs obviously offer more diversification than owning individual properties and are far more liquid.

What needs to be considered:

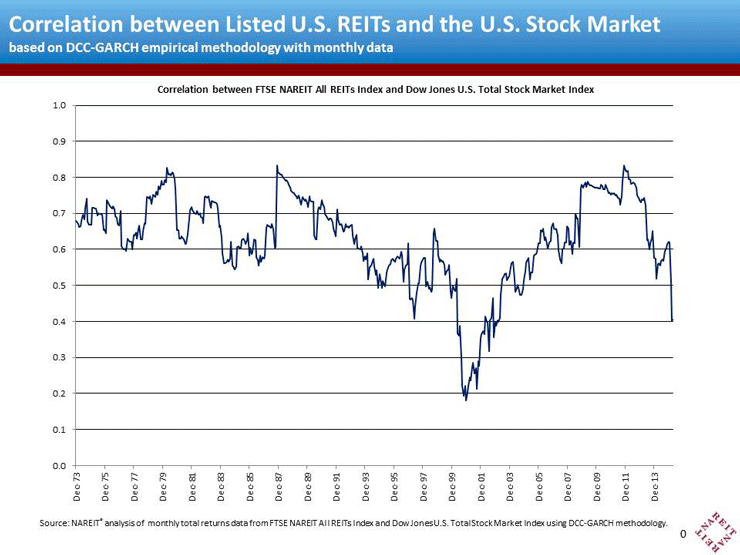

REITs have a strong positive correlation with the stock market.

Since 1972, REITs have generally stayed between a 0.56 and 0.72 correlation to the US stock market. The correlation low was around 2000, when the US stock market was in the midst of the dot com boom. The irrationality of a tech-bubble stock market resulted in a short lived, very low REIT correlation.

Why is this positive correlation to stocks important to keep in mind now?

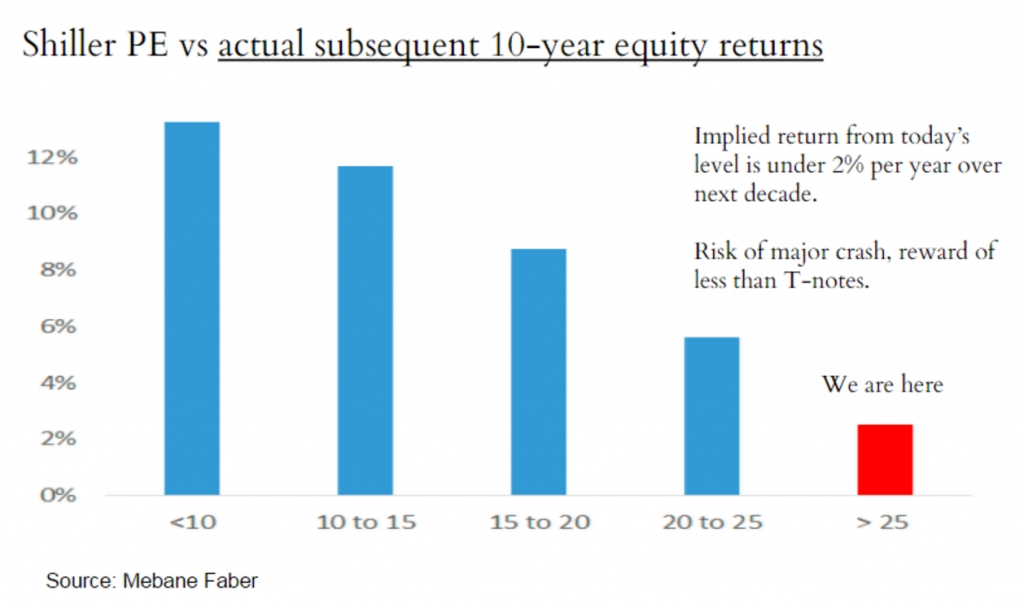

US stock market valuation multiples (such as the Shiller PE and the price:sales ratio) are at levels that have always been followed by losses and very low returns over the next ten year period.

If we have a dip in the stock market, REITs will be affected.

Option C: Treasury Bonds

The 30 year treasury bond is currently paying 2.8%.

This is obviously not a great return.

While treasury bonds are liquid and safe, they do not provide protection against inflation.

Should inflation rise at all while you hold bonds, you’ll be out of luck.

Corporate bonds are providing slightly higher returns, but with greater risk.

Option D: Income Producing Commercial Real Estate

It is still entirely possible to get a 5% or even 6% cap rate with solid, income producing commercial real estate in Miami.

While less liquid than bonds, you get a significantly higher return. And should inflation go up, you will be protected as rents will most likely increase.

Furthermore, purchasing self-standing commercial properties opens you up to the possibility of benefiting from Miami’s continuous growth and expansion. You stand to potentially benefit from future up-zoning as well as acquisition by developers looking to put together multiple parcels.

Ask yourself: where are there shortages in the market?

While the Miami condo market is suffering a decline in demand, the city has a severe shortage in affordable and Section 8 housing.

With Section 8 housing in particular, there is excellent opportunity to get some fantastic returns. A multi-family structure converted to Section 8 would generate stable rent, direct-from-the-government. Section 8 rent is, generally speaking, above market rates and the tenants are single moms who don’t want to move. It is quite possible to get an 8+ Cap with Section 8 housing in Miami. And I cannot emphasize how much better it is to get rent money from the government rather than having to collect from individual tenants!

There are excellent returns to be found in the Miami real estate market today.

You just need to know where to look.

Contact me for further information.

pharmacy http://irususpren.strikingly.com/

Thanks a lot, Loads of information.

Discount viagra http://verdohelp.strikingly.com/

Cheers. Fantastic information!

Generic viagra http://geschviterg.strikingly.com/

Nicely put, Regards!

Viagra for sale http://viagravipsale.com/

Seriously tons of amazing info!

canadian pharmacy viagra brand http://www.buylevitraa.com/

Many thanks. Excellent stuff.

Google

Although websites we backlink to beneath are considerably not associated to ours, we feel they may be truly worth a go by means of, so possess a look.

top rated online canadian pharmacies http://www.viagravonline.com/

Awesome information. Cheers.

online pharmacy http://www.buylevitraa.com/

Nicely put, Thanks a lot.

canadian pharmacy viagra brand http://www.viagraessale.com/

Terrific info. Thank you!

canadian pharmacies online prescriptions http://www.viagravonline.com/

Nicely put. Regards!

online canadian pharmacies http://canadiantousapharmacy.com/

Kudos, Quite a lot of stuff!

canadian pharmacy cialis http://canadianpharmacyes.com/

Terrific material. Appreciate it!

Canadian Pharmacy USA http://withoutadoctor.viagraiy.com/

You definitely made your point.

canadian pharmacies online https://viagravonline.com/

You actually revealed it exceptionally well.

debit card loans [url=http://cashfastlot.com/]installment loans[/url] personal loans quick loans advance cash on line

24 hour loan [url=http://moneylendingbtd.com/]quick loan[/url] cash loans in an hour cash loan no credit check cash america

cashadvance [url=http://loanpaydaythz.com/]fast cash 500[/url] paycheck advance home loans for bad credit payday express

cash loans bad credit [url=http://cashonlinesbj.com/]cash online[/url] loan pay day loans california cash in 1 hour

cash advance usa [url=http://payloanrgo.com/]cash advance with[/url] cash today cash advance with home loans for bad credit

Epitol [url=http://gabapentinneurontinax.com/]Aricept[/url] Epivir Lyrica Chloroquine

Haldol [url=http://meloxicammobicxn.com/]Colchicine[/url] Kamagra Gold Uroxatral Haldol

no faxing payday loans online [url=http://paydayloansdwt.com/]online payday loans[/url] badcredit payday loans no credit check no faxing payday loans payday loans

instant online payday loans [url=http://paydayloansuyi.com/]instant online payday loans[/url] faxless payday loans one hour payday loans no credit check payday loans

no teletrack payday loans [url=http://paydayloansdwt.com/]pay off payday loans[/url] payday loans phone no credit payday loans no fax payday loans

Hydrea [url=http://gabapentinneurontinax.com/]Dramamine[/url] Zerit Meclizine Aricept

payday loan lenders [url=http://paydayloanrgh.com/]payday loan without credit check[/url] savings account payday loan new payday loan direct payday loan companies

the best payday loan companies [url=http://paydayloanjyd.com/]not a payday loan[/url] best payday loan payday loan usa payday loan no checking account

Regards. Quite a lot of data. do you have to wean yourself off lisinopril

payday loans companies [url=http://paydayloansuyi.com/]payday loans direct lenders only[/url] no fax payday loans online payday loans without direct deposit payday loans company

Avodart [url=http://meloxicammobicxn.com/]Uroxatral[/url] Fincar Finax Malegra DXT

Zyprexa [url=http://meloxicammobicxn.com/]Speman[/url] Mentat Noroxin Malegra FXT

Vastarel [url=http://gabapentinneurontinax.com/]Aldactone[/url] Hydrea Antabuse Requip

Regards. A lot of write ups. cialis free trial.

coursework writers [url=http://courseworkhelpxeg.com/]coursework psychology[/url] data analysis coursework coursework plagiarism checker custom coursework writing service

Good postings. Many thanks.. online doctor viagra

Amazing forum posts. Appreciate it. do you need a prescription for viagra

Really many of valuable knowledge. generic drug for viagra.

essay paper writing help [url=http://essayonlinethx.com/]write custom essays[/url] urgent custom essays buy an essay paper best college application essay service

buy a research paper for college [url=http://researchpapershrd.com/]need help writing research paper[/url] buy apa research paper help to do a research paper research paper buy

how to write a phd thesis [url=http://thesissgj.com/]law thesis[/url] thesis coaching good thesis statement help with thesis statement

Hello there! [url=http://canadianonlinepharmacyhq.com/]online medical[/url] best canadian pharmacies online medical information

Hi there! [url=http://buyeddrugs.com/]buy ed pills uk[/url] ed pills online ed pills online

Hello there! [url=http://buyeddrugs.com/]http://buyeddrugs.com[/url] – erectile dysfunction pills online good internet site

term paper writing service [url=http://essaywritersrpl.com/]buying term papers online[/url] cheap custom term papers help with term paper writing term paper help

Hello! [url=http://buyeddrugs.com/]ed pills online[/url] erectile dysfunction pills online ed pills online

Hi! [url=http://imitrex-sumatriptan.com/]buy imitrex online without prescription[/url] buy imitrex cheap buy imitrex online

Hi! [url=http://imitrex-sumatriptan.com/]http://imitrex-sumatriptan.com[/url] – generic sumatriptan great website

Hello there! [url=http://imitrex-sumatriptan.com/]buy sumatriptan[/url] purchase imitrex online no prescription generic sumatriptan

buy term papers essays [url=http://termpapernfu.com/]help with term papers[/url] college term papers for sale help with term papers order custom term paper

Hello there! [url=http://imitrex-sumatriptan.com/]http://imitrex-sumatriptan.com[/url] – order sumatriptan beneficial internet site