Next event

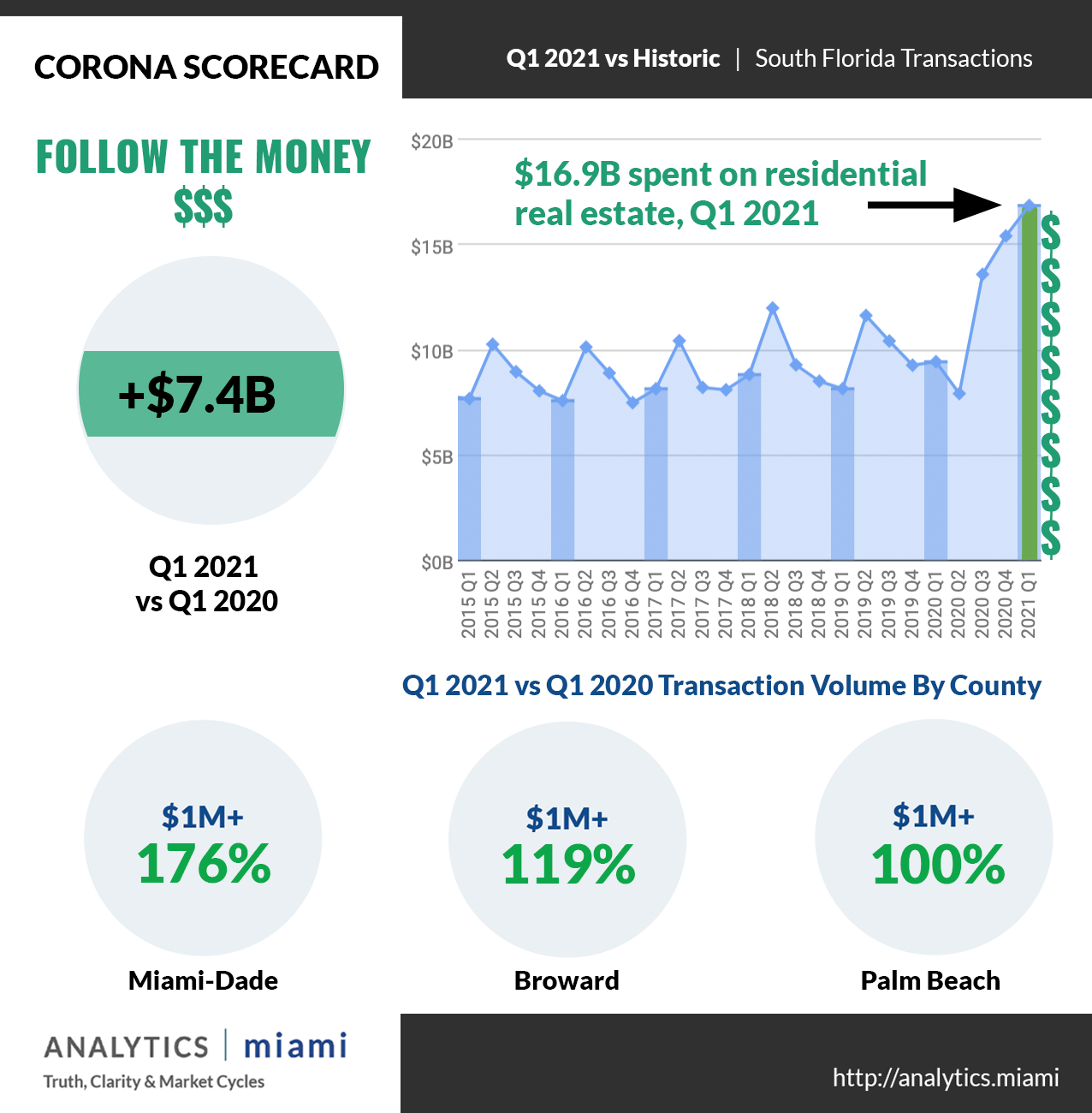

South Florida 2021 & Beyond: Follow the Money

Date & Time

Wednesday, April 14, 2021 | 12PM

Location - Tower Club Fort Lauderdale

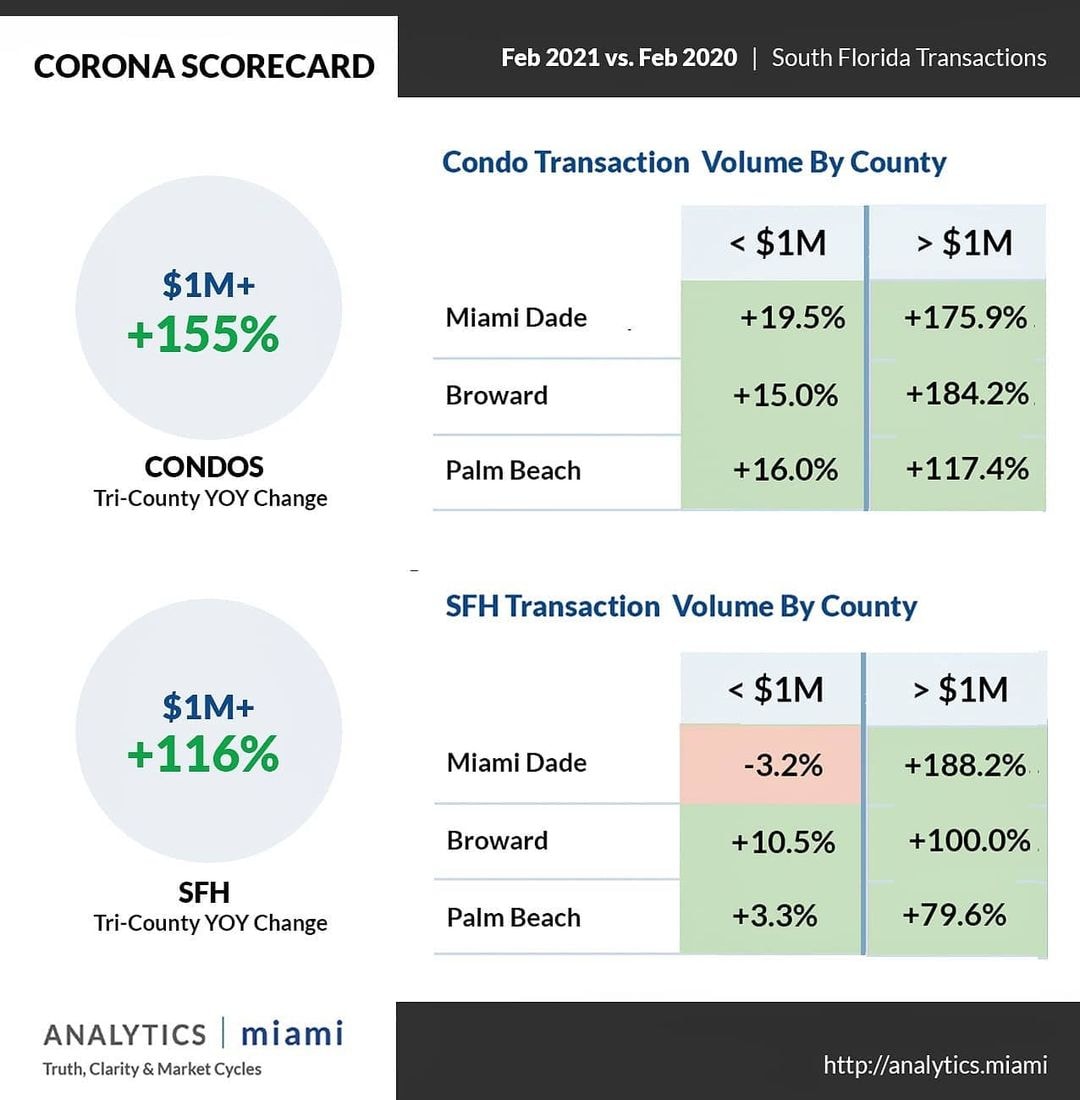

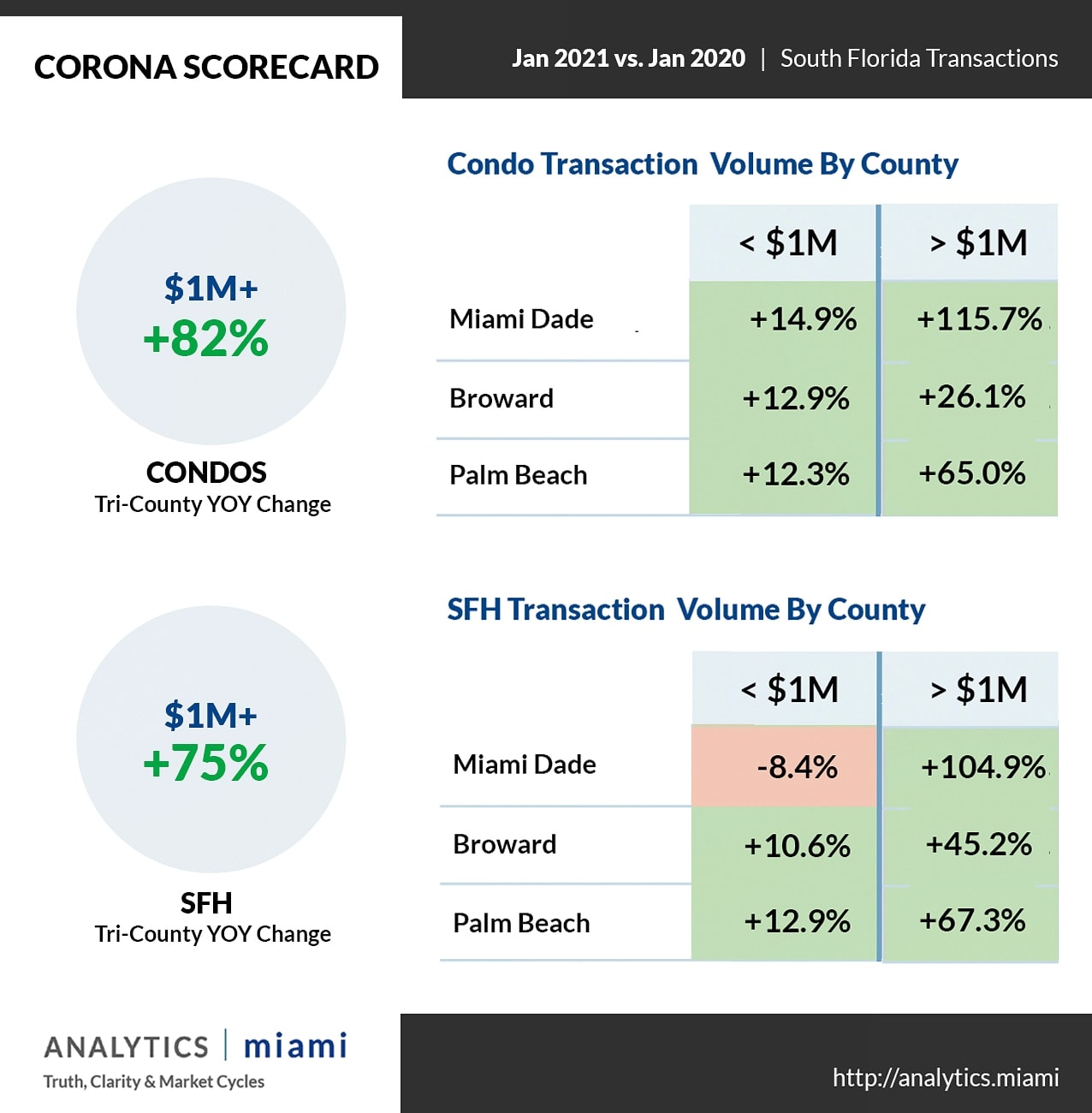

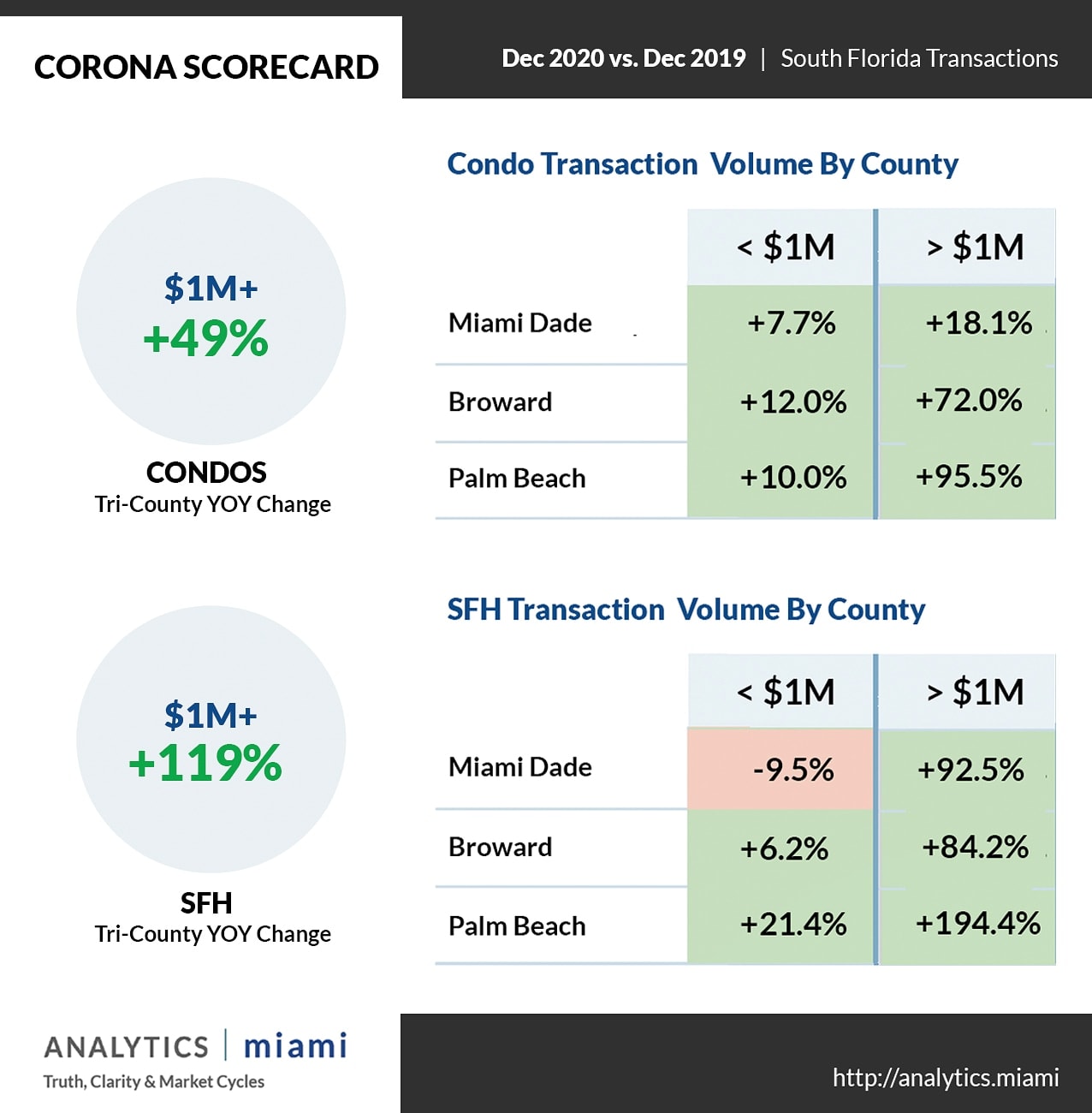

Corona Scorecard: South Florida Single Family Home Market

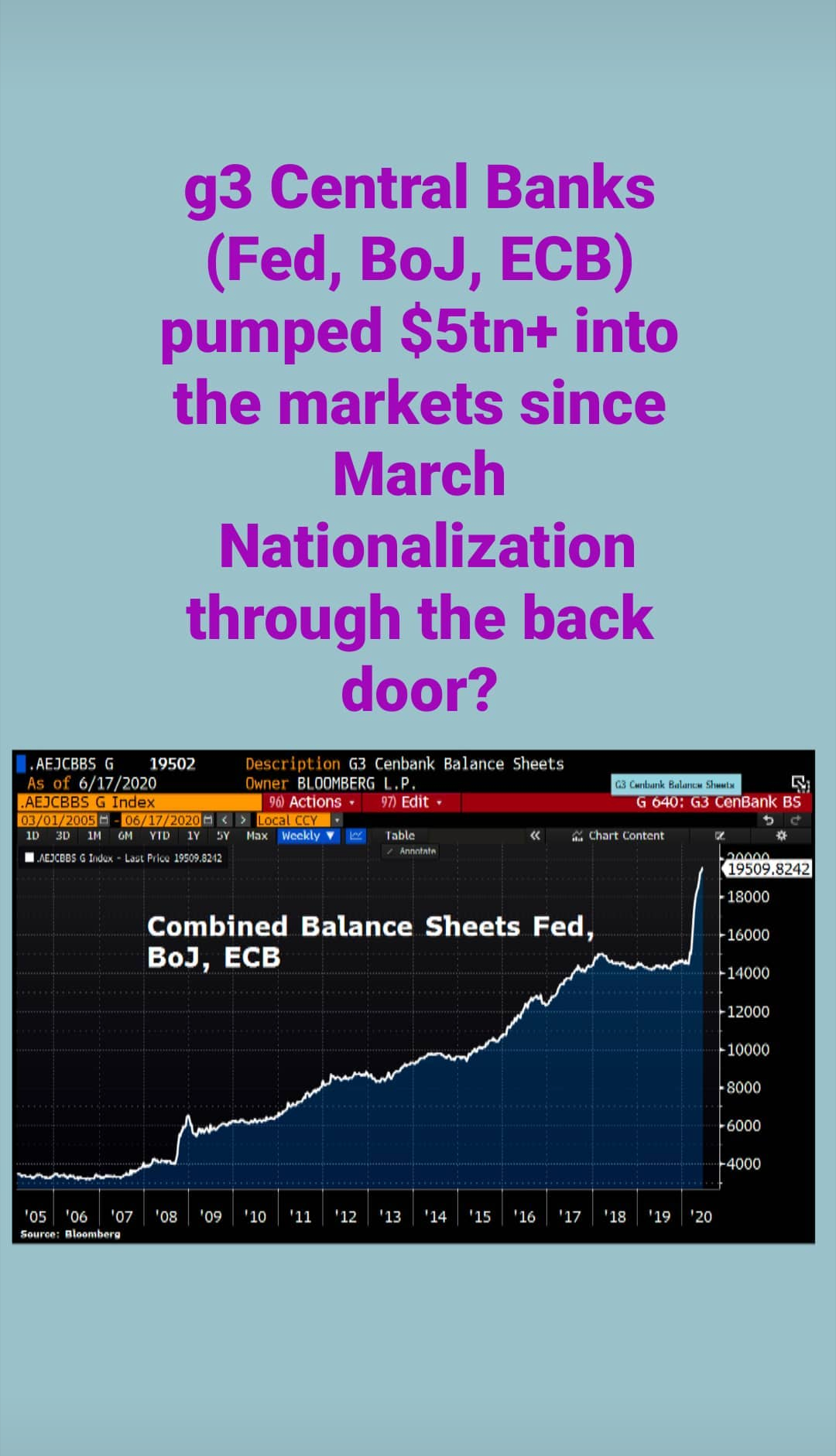

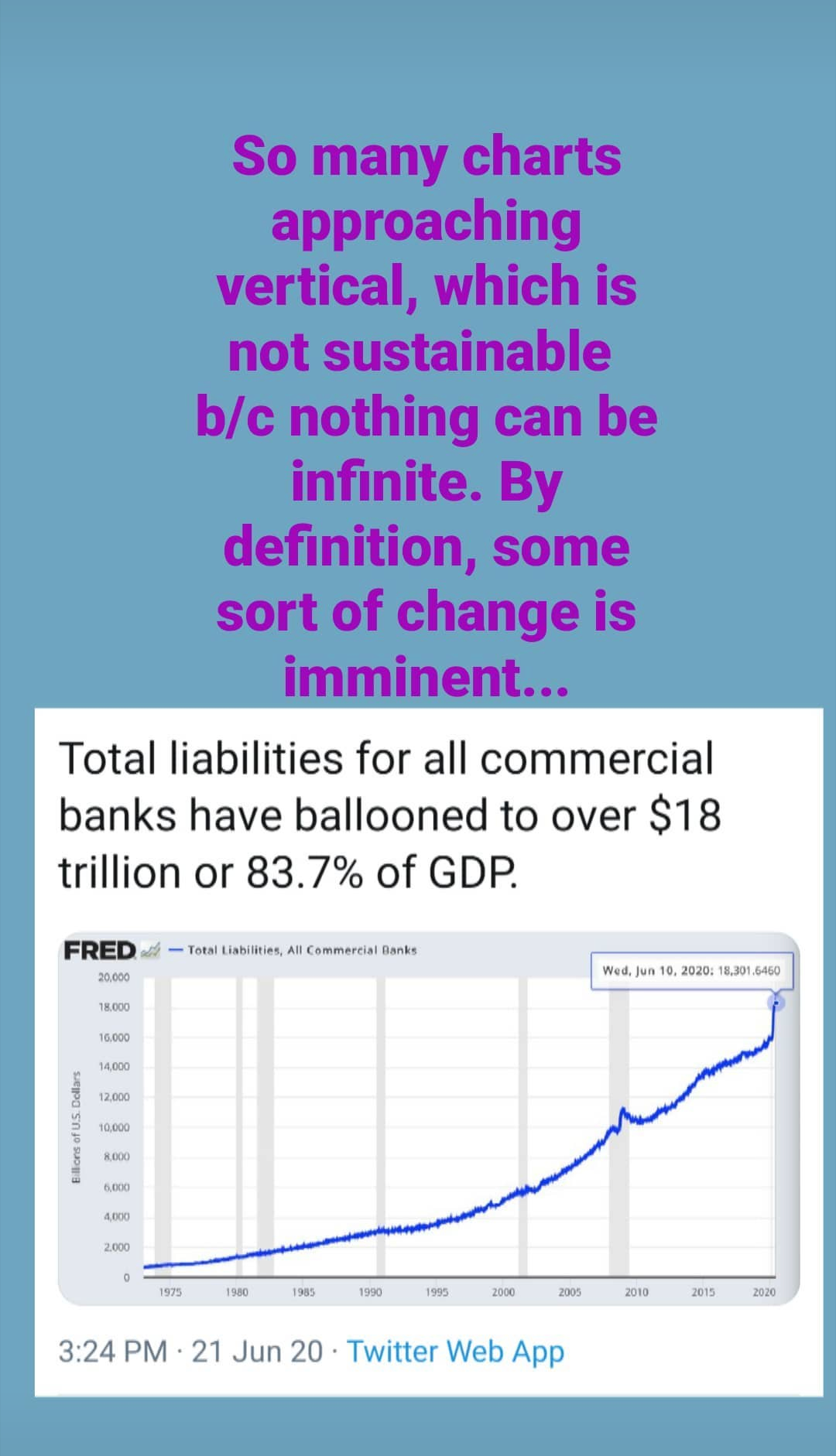

The South Florida real estate market does not exist in a vacuum, so it is important to define underlying trends.

> Corona as an accelerator of trends:

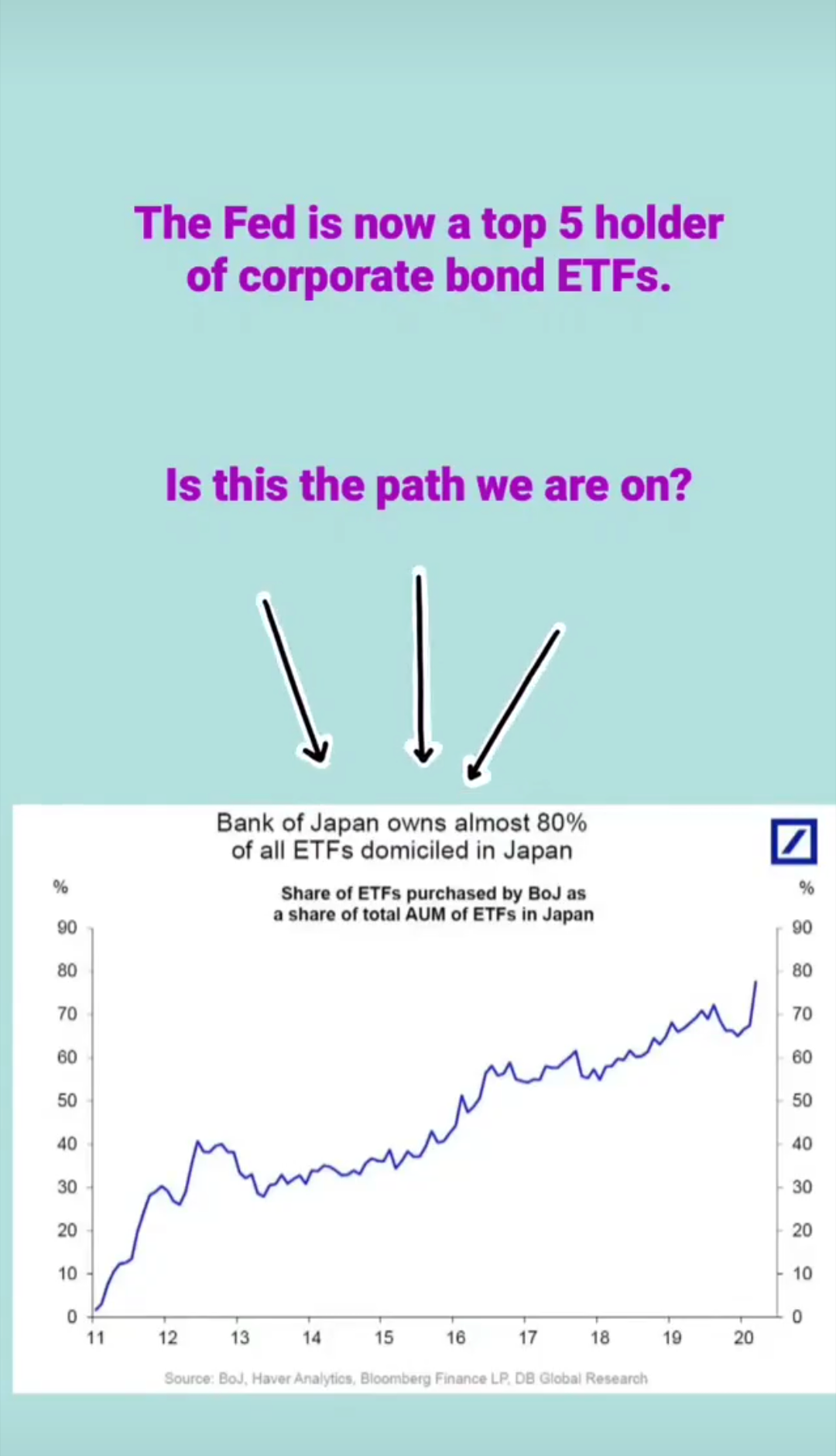

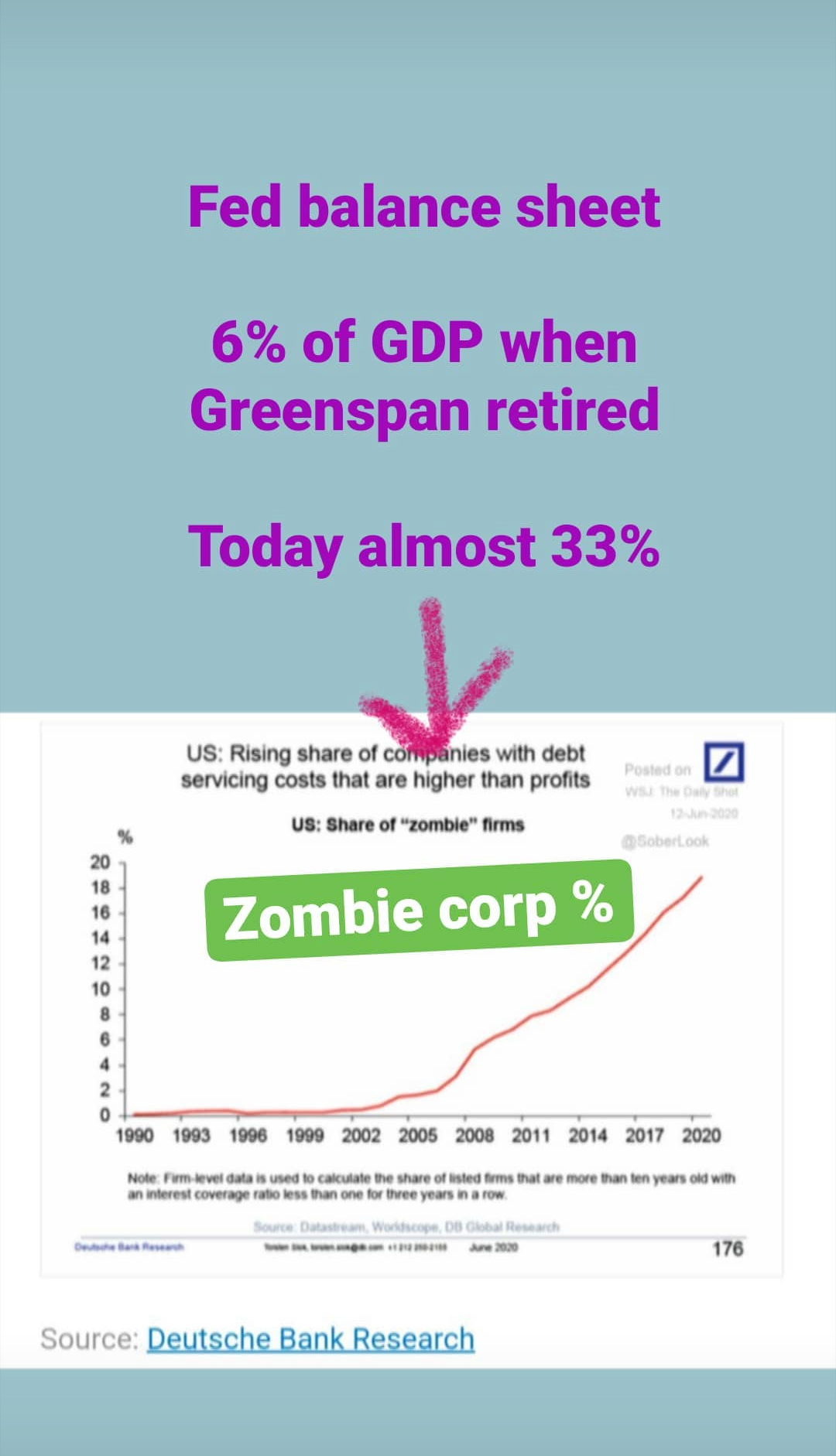

----> wealth gap, virtualization (work and school), monetary policy, debt, monetary policy, pricing of risk, etc...

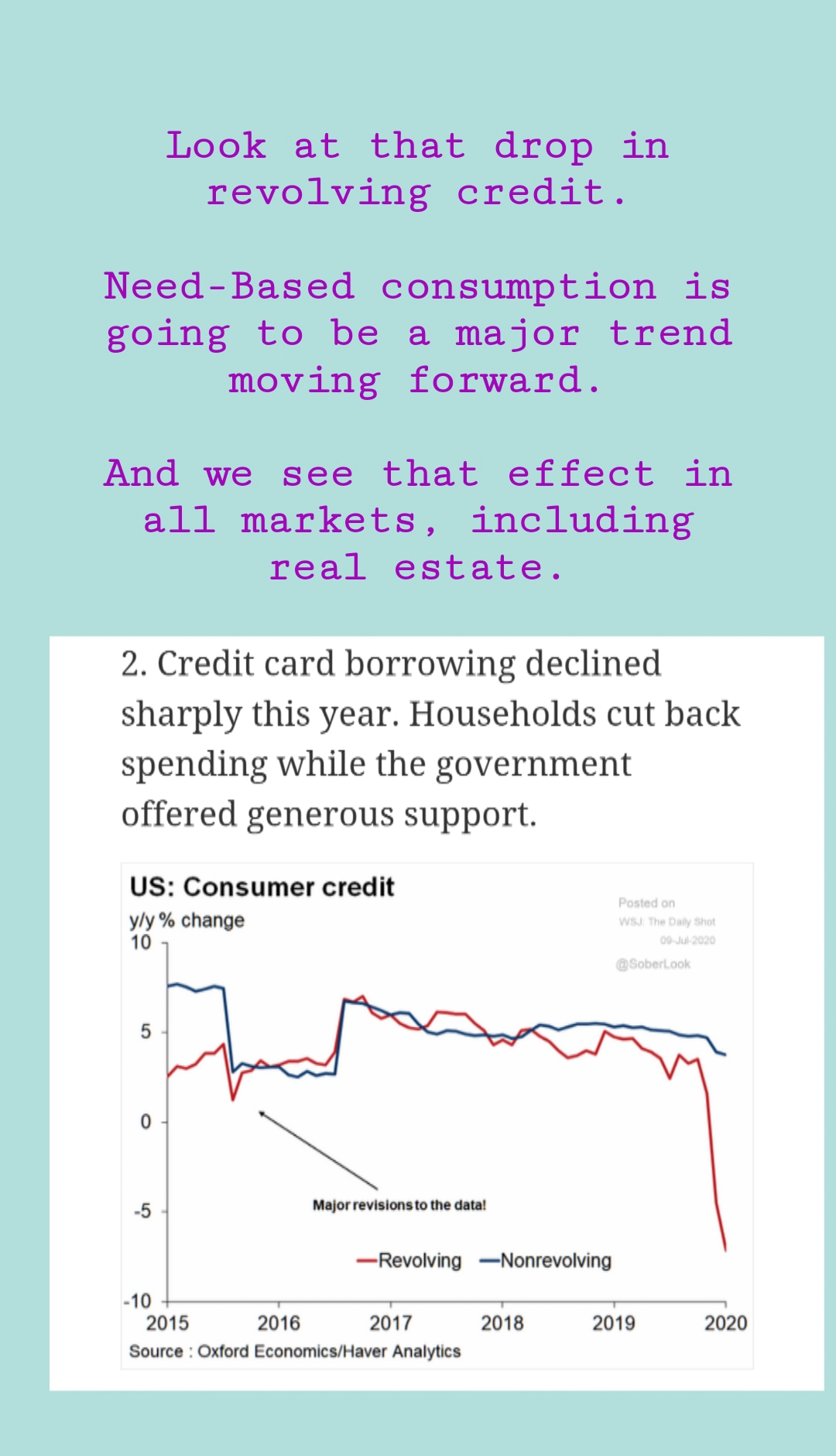

> Big trend underway: atavistic reversion to need based consumption ---> we see this in the South Florida real estate data

> Global event, I believe this is a major shift in the post-WWII status quo ---> and this can be a positive, much of how we conduct of our lives is a relic of the post WWII world

> Reversals to globalization and the introductions of protectionist measures