There is a fundamental disconnect between supply & demand in the Miami and Miami Beach condo markets. Inventory has steadily risen across market segments, all while transaction volume has dropped off. Higher price points are the worst offenders. The Miami $1M+ market saw a 147% increase in supply since 2013, while sales dropped 32% in the same period

Macro Updates + Miami High end single family: best performing segment in August 2023

August numbers are in, and the prevailing trends remain strong:

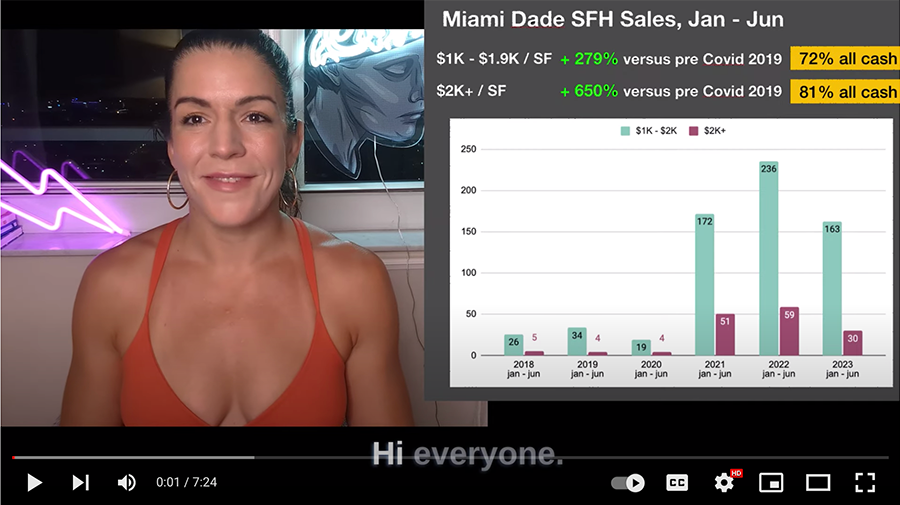

1) For purposes of discussion, we have two markets: the very high and and everything else. --> August sales volume of SFH past $1K / SF was higher than last year, despite overall volume drops. (Contact me for on & off market opportunities & buildable lots)

2) Data quantifying macro trends pushing high value domestic migrants keeps coming in. It is my belief that forces pushing high net worth domestic migration are still in their infancy.

1) August Numbers: the high end continues to outperform

If we believe the thesis that Miami will continue to ascend (which I do), then the best residential play is this:

locking in land value aligned with scarcity via SFH plays within the proximity of the urban core.

Buying waterfront on Palm Island, Hibiscus Island, La Gorce Island, etc...is like buying near Central Park in NYC 80 years ago. I discussed this with my friend Karen Apsrea, in the visionaries section of Miami Deal Sheet >

And once again, the best performing market segment in August 2023 was the SFH past $1K SF segment:

The pattern holds tri-county. Product past $1K/ square foot caters to the domestic wealth & talent migration.

The pattern holds tri-county. Product past $1K/ square foot caters to the domestic wealth & talent migration.

2) Data quantifying macro trends pushing wealth and talent to South Florida keeps coming in

www.bloomberg.com/graphics/2023-asset-management-relocation-wall-street-south

This article quantifies the movement of investment firms with assets under management.

Both CA and NY lost close to $1 Trillion in assets, according to corporate filings.

And how remarkable is this:

"Connecticut, the hedge fund hub that’s long appealed to firms wanting to stay close to New York without being in the city, has now fallen behind Florida in assets under management."

The ramifications are staggering, both the negative and the positive.

NYC tax rev taking a tumble. The Latin American playbook will accelerate.

The Miami Herald asked me if I think buyers of homes, at or below the median resale price, should wait or buy now. The full article is here: https://www.miamiherald.com/news/business/real-estate-news/article278824969.html. and here is my video answer:

MiamiDealSheet.com - now live

The best deals in Miami

Powered by Analytics Miami, hand-picked by Ana

Reports, interviews & feature spotlights

Get on Ana’s List

I personally work with a select number of buyers every month.