Thank you Peter Santanello for shooting an episode with me:Inside Wealthy Miami – Why Are So Many Americans Moving Here? Thank you Wall Street Journal for using my data and quoting me in this excellent article: Million-Dollar Homes Skyrocket in Miami, as Starter Properties Go Extinct.

2023 Intrastate Migration Numbers Released by the Census: TX & FL winning

Given that the census figures just came out, this is a fitting time for this quote of mine recently in the Real Deal:

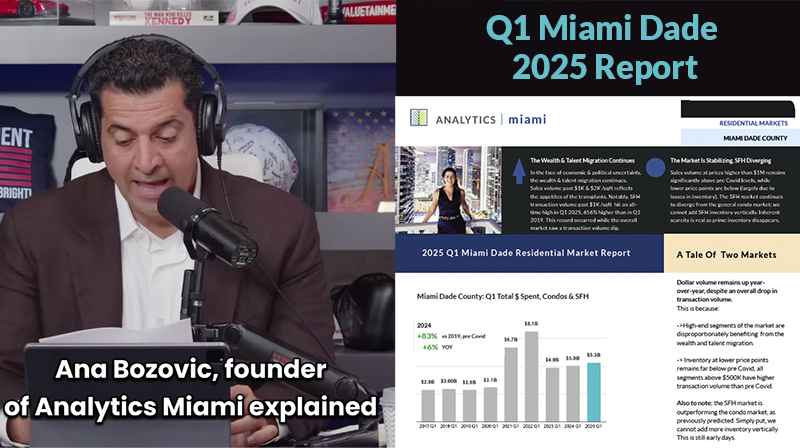

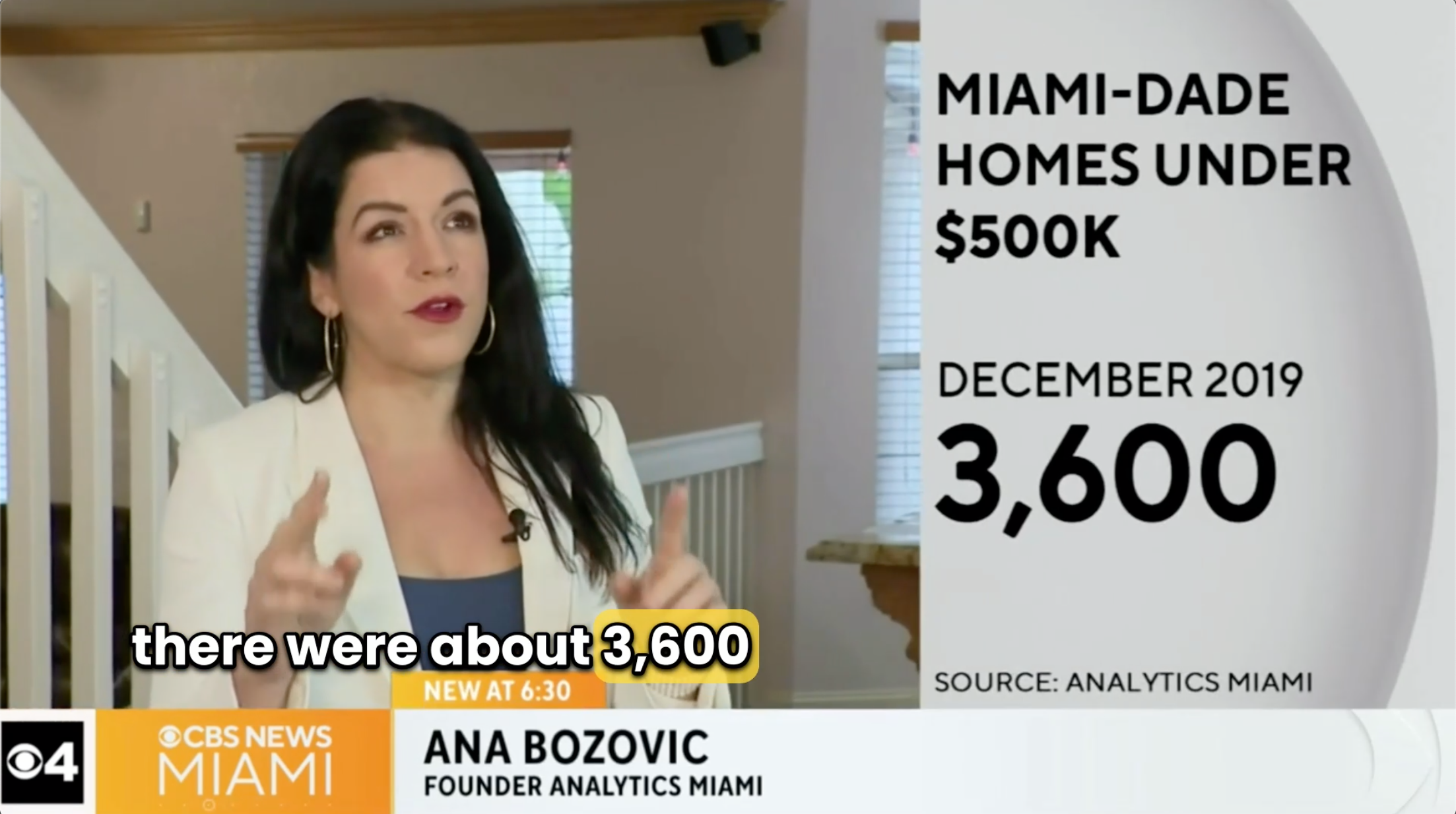

Ana Bozovic, broker and founder of Analytics Miam, saiid segments of the residential market that are

“catering to the wealth and talent migration,” such as the single family market, are outperforming everything else.

“This is all part of the ongoing polarization of wealth and belief systems I keep talking about and I don’t see it reversing.”

Article: https://therealdeal.com/miami/2024/10/20/the-weekly-dirt-south-florida-condo-market-weakens/

Download my full Q3 2024 Miami Real Estate Report

2023 Intrastate migration numbers are in, just released at census.gov.

Rather unsurprisingly, the post Covid trend continues. TX & Florida are once again #1 & #2 when it comes to net intrastate migration gains.

Scroll down to see the chart & exact numbers.

* Blue states, that tended to be high lock-down & are high-tax, keep losing population. (This is an observation, I am a registered independent). The top five population losers were all blue states.The two winners (TX & FL) have no state income tax. The two biggest two losers (CA & NY) have among the highest levels. I do not report on this with any personal joy, I grew up in NYC. It is what it is.

Actions speak. And I do not see this trend reversing. Meaning: I do not see a large reverse migration of tax payers into high tax states. And again, this is why Miami SFH sales past $1K and $2K per square foot are at all time highs.

Habits were broken during Covid, and life is reshaping (for some) around the capabilities of the internet. New 21st century epicenters and financial capitals are emerging.

* According to an Altrata report from earlier this year, the number of Ultra High Net Worth individuals in the US grew by 13% last year.

The wealth and talent migration is very real, as is America’s polarization of wealth & belief systems.

* Faena District Miami River announced, contact me for details

It it is the wealth & talent migration + the growth of wealth at the top that is fueling Miami’s prime, luxury markets. See below for a new release from Faena, as an example of a Miami project that is positioning itself to benefit from the continued action at the top and Miami’s continued ascension.

Faena District Miami River is Announced

Sales to begin at the end of this year.

Contact me for details.

Get on Ana’s List

I personally work with a select number of buyers every month.