Just Released: Analytics Miami 2025 Q4 Report & Forecast Themes of the week: Wealth Migration • 2025 Q4 Report & Forecast • New Interviews Wealth migration is the theme of the week, and will be the theme of the century. Global HNWI relocations reached record levels in 2025 and still increasing into 2026. Within the United States, a clear trend persists: high value tax payers are relocating and our feeder jurisdictions are predictably increasing their hostilities to capital. The net effects of California billionaire tax are obvious. Recall that Bezos moved to Miami when his home state proposed a wealth tax. He would have accounted for 45% of the theoretical revenue. Today I read that the Netherlands is likely to start taxing unrealized capital gains at 35%. One starts to wonder what these regimes may start doing to curtain inevitable exoduses. Wealth mobility is real. Miami's emergence as a destination for wealth is evident in the year-end and Q4 numbers.

Q1 2025 Miami Dade Real Estate Report

Q1 and April have wrapped up, and the tale-of-two-markets story continues.

This is fully explored in my Q1 2025 Miami Dade Report.

Understanding this is key to finding opportunities – contact me directly to discuss.

Work with me directly to find the best deals in Miami.

Invest aligned with growth and scarcity.

====

Thank you to the Patrick Bet David podcast for the shout-out and for shining a light on this very important reality of the Miami Dade real estate market. In the video, Patrick is reading from the Wall Street Journal article in which Ana Bozovic of Analytics Miami contributed thoughts & charts. The segment Patrick reads highlights how active single family home listings in Miami Dade county sub $500K are down over 80% now versus pre Covid 2019. There are currently only about 600 listings (not filtering out for teardowns and land value sales). The price point is going extinct.

Download the full annual 2025 Q1 Miami Dade Real Estate Report & Forecast

Some highlights from the Analytics Miami Q1 2025 Miami Dade Real Estate Report:

-> SFH past $10M had record high transaction volume in Q1 2025

> all market segments past $500K had significantly higher transaction volume than pre Covid

-> Condos past $2.5M had YOY transaction volume growth.

-> SFH past $1M had YOY transaction volume growth

-> for all the talk of surging inventory (in Newsweek for example), inventory of SFH below $500K remains down 84% vs pre Covid.

===

CASH:

At $1M+, the Miami Dade condo market was 74% all cash in Q1.

Past $2K / sq ft, the condo market was 81% all cash.

The SFH market saw 82% all cash past $2K / sq ft.

===

As I have previously discussed: wealth polarization is a very real thing.

I believe that segments catering to the upper echelons of wealth will continue to reach new highs over the next 5-10 years. And inherent scarcity will help this –> this is why I am so bullish on prime, waterfront SFH. We keep seeing articles about record prices, and I contributed to a number of them. The growth to $100M houses is very real. And prime waterfront represents prime scarcity.

New dev scoop: contact me directly for special pricing at a new project in Coral Gables (right by Coconut Grove). This project checks every box, including Wellness. This is ground zero pricing, which is the ideal way to invest in a condo. See below in this email for more details.

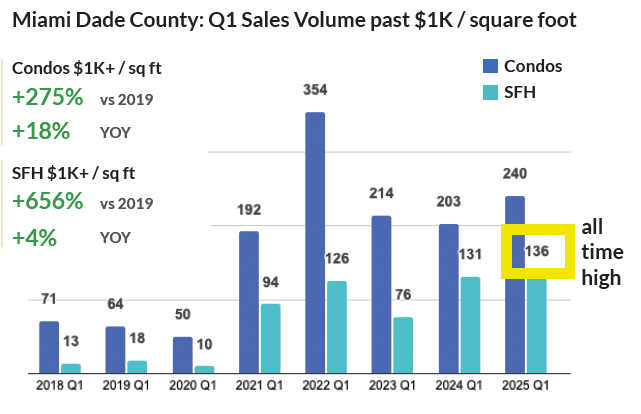

Sales Volume Growth Past $1K / sq ft continues