Themes of the week: UBS “Bubble” Report • Rock The Market Highlights • Special Invitations. Thank you to the South Florida Business Journal for quoting me on this topic. The UBS "Bubble" report is a travesty and they should be embarrassed. This report a sensationalist misuse of a global platform, and its misleading headline is being echoed by press worldwide. * An invitation: Join me, I am speaking at the Real Deal Conference. 📍 Mana Wynwood | November 5 & 6 I am speaking on Nov 6 in a first-ever, special debate style panel with Daniel Kodsi. https://events.therealdeal.com/event/how-to-survive-the-squeeze * An invitation: Join me for my super fight at Main Character Jiu Jitsu 📍 La Scala De Miami Brickell | October 19 Tickets here, please select me at checkout: https://nitrotickets.com/event/1064/MCJJ-1HALLOWEEN-1HAVOC-1--11019

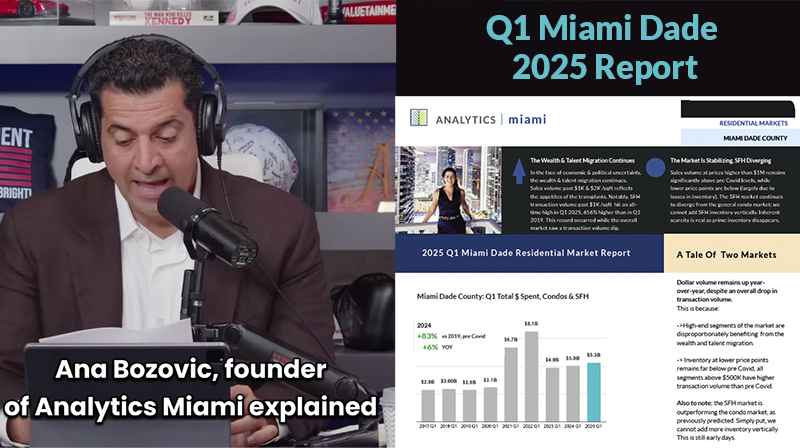

September 2025 Miami Real Estate update: Fed rate cuts & Ana Bozovic on Fox News Live

Ana Bozovic appeared live on Fox News, on Varney & Co and The Big Money Show.

Remember: entrepreneurship flows towards the path of least resistance. Our feeder jurisdictions, such as NYC, will only increase their hostilities towards capital.

Mr. Mamdani is a prime example.

Wealth is increasingly mobile, and the top 1% of tax payers account for almost 50% of tax rev in high tax jurisdictions.

As Ana puts it in this video: you can only boil the frog for so long.

Download the full annual 2025 Q2 Miami Dade Real Estate Report & Forecast

The Fed Just Cut Rates – What Does This Means for Miami Real Estate?

The Federal Reserve cut rates by 25 basis points this week, with Powell signaling the possibility of two more cuts before year-end.

Implications for Miami:

- The net effect will be an increase in monetary flow into the market. More money, more participants.

- Importantly, Miami’s steep growth in median pricing, and the meteoric rise of super-luxury, happened in the face of elevated rates. Segments that soared under pressure will likely climb even higher as conditions ease.

- First-time buyers, however, will see little relief. Inventory of single-family homes under $500K remains more than 80% below pre-Covid levels. Lower rates will not add significant supply to our market, but will add more competition.

Big Picture: Market pricing is the aggregate of all the forces at play.

Market pricing is always the aggregate of forces at play. For South Florida, the driving force remains wealth migration, both domestic and global. Our region has become the path of least resistance for wealth, creation, and entrepreneurship. That trend is not reversing anytime soon.

Even with Powell acknowledging inflation concerns, the likely trajectory is continued rate cuts. That means more liquidity, more buyers, and more momentum flowing directly into Miami real estate. The math is clear.

——