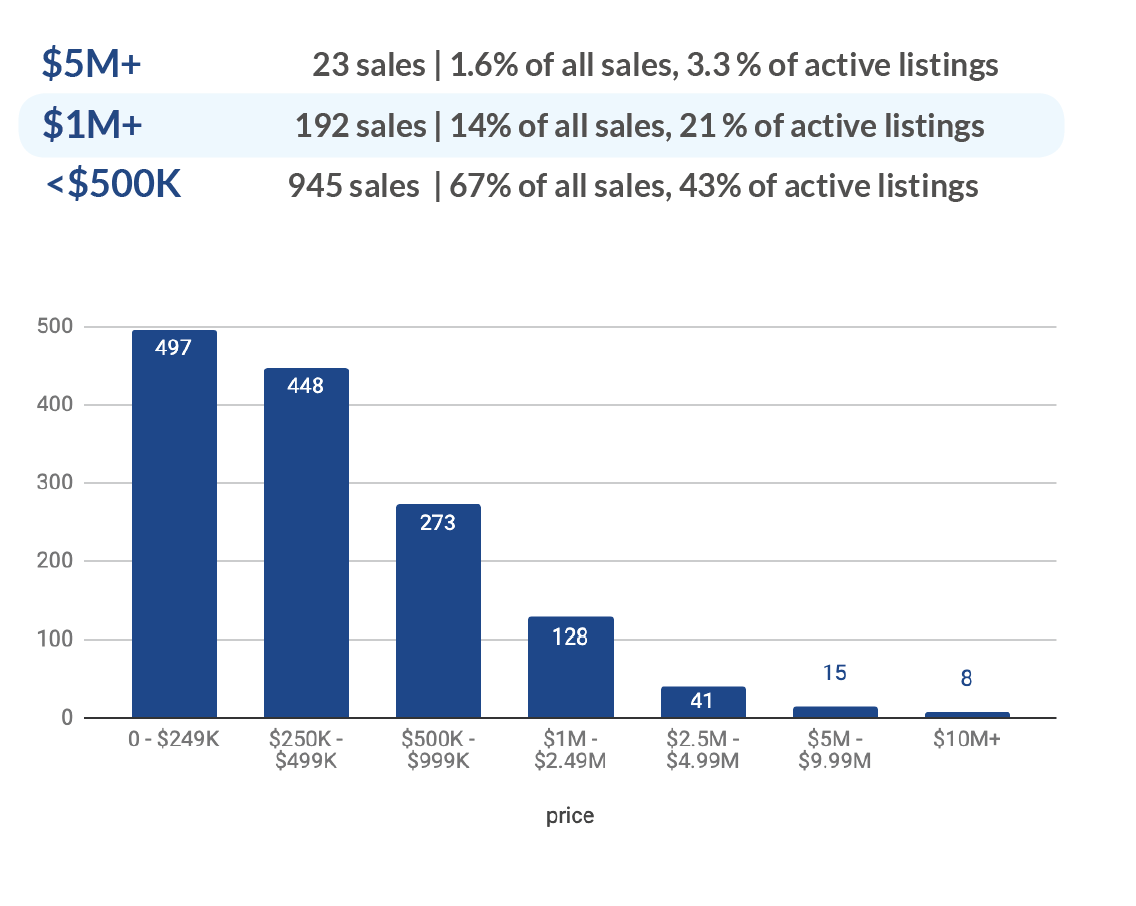

There is a fundamental disconnect between supply & demand in the Miami and Miami Beach condo markets. Inventory has steadily risen across market segments, all while transaction volume has dropped off. Higher price points are the worst offenders. The Miami $1M+ market saw a 147% increase in supply since 2013, while sales dropped 32% in the same period

Q3 2019 Supply & Demand Report: Miami Condos & Miami Beach Condos

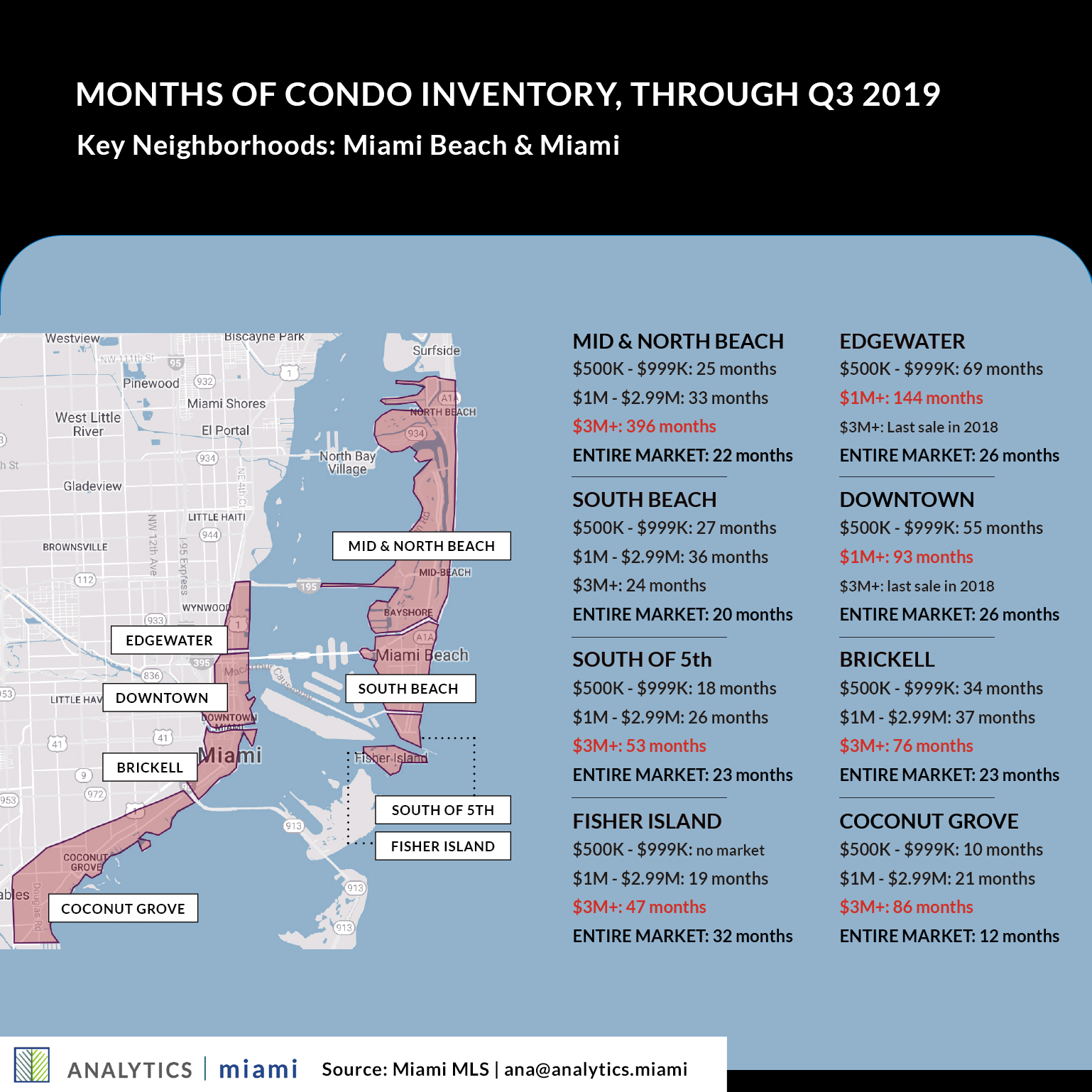

Inventory remain near highs, with some neighborhoods seeing 100+ months of luxury inventory.

Ana's Comments:

The macro drives the micro, and all markets are governed by supply and demand. When making investment decisions, awareness of the current market cycle is key. Nothing goes up forever and nothing goes down forever; you just need to know which side of the slope you are on.

Infographic: Miami Condo Market, Months of Inventory Across Key Neighborhoods

Miami Beach Condo Market through Q3 2019.

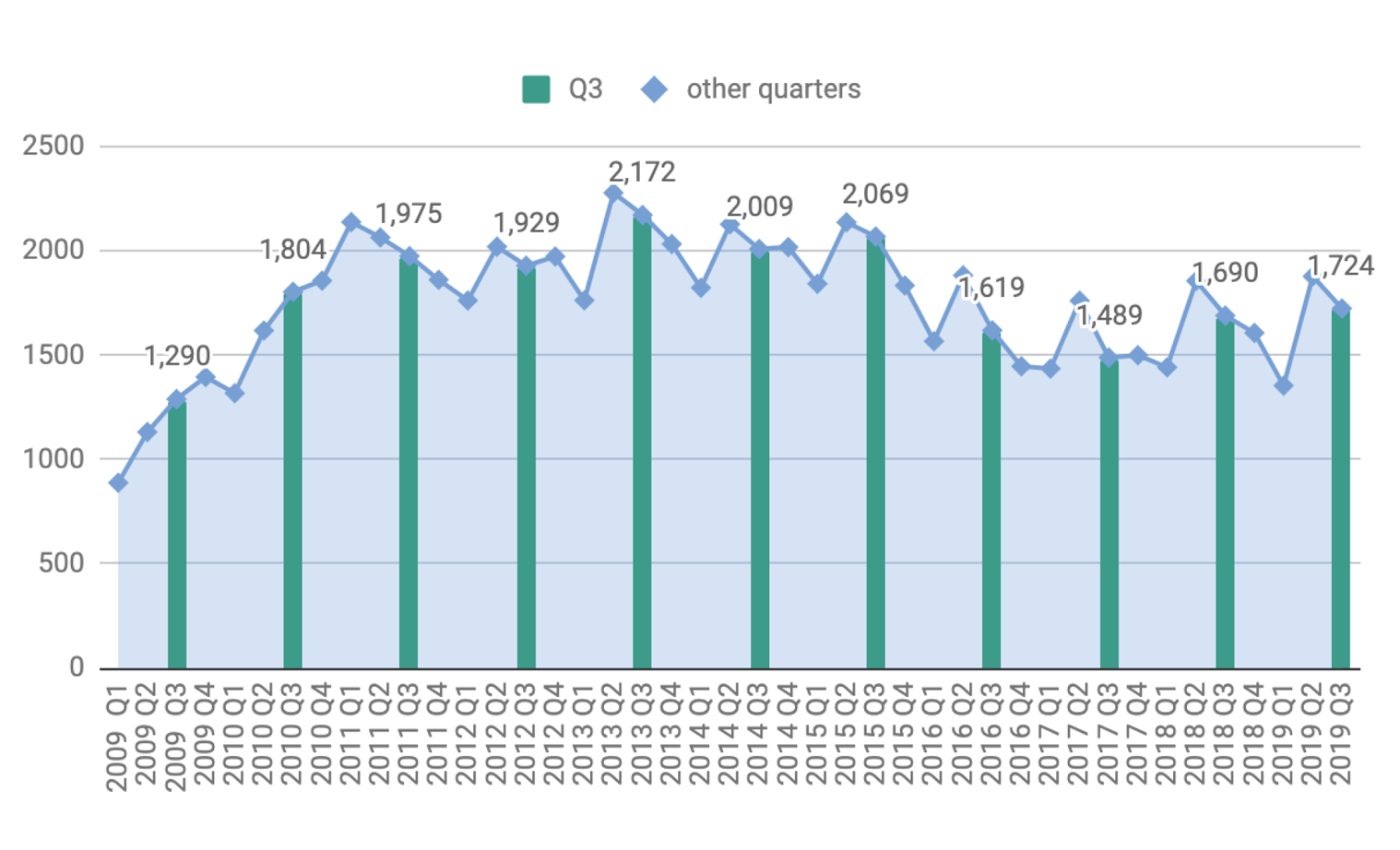

Transaction Volume & Inventory Charts.

Charts indicate a substantial supply-and-demand disconnect.

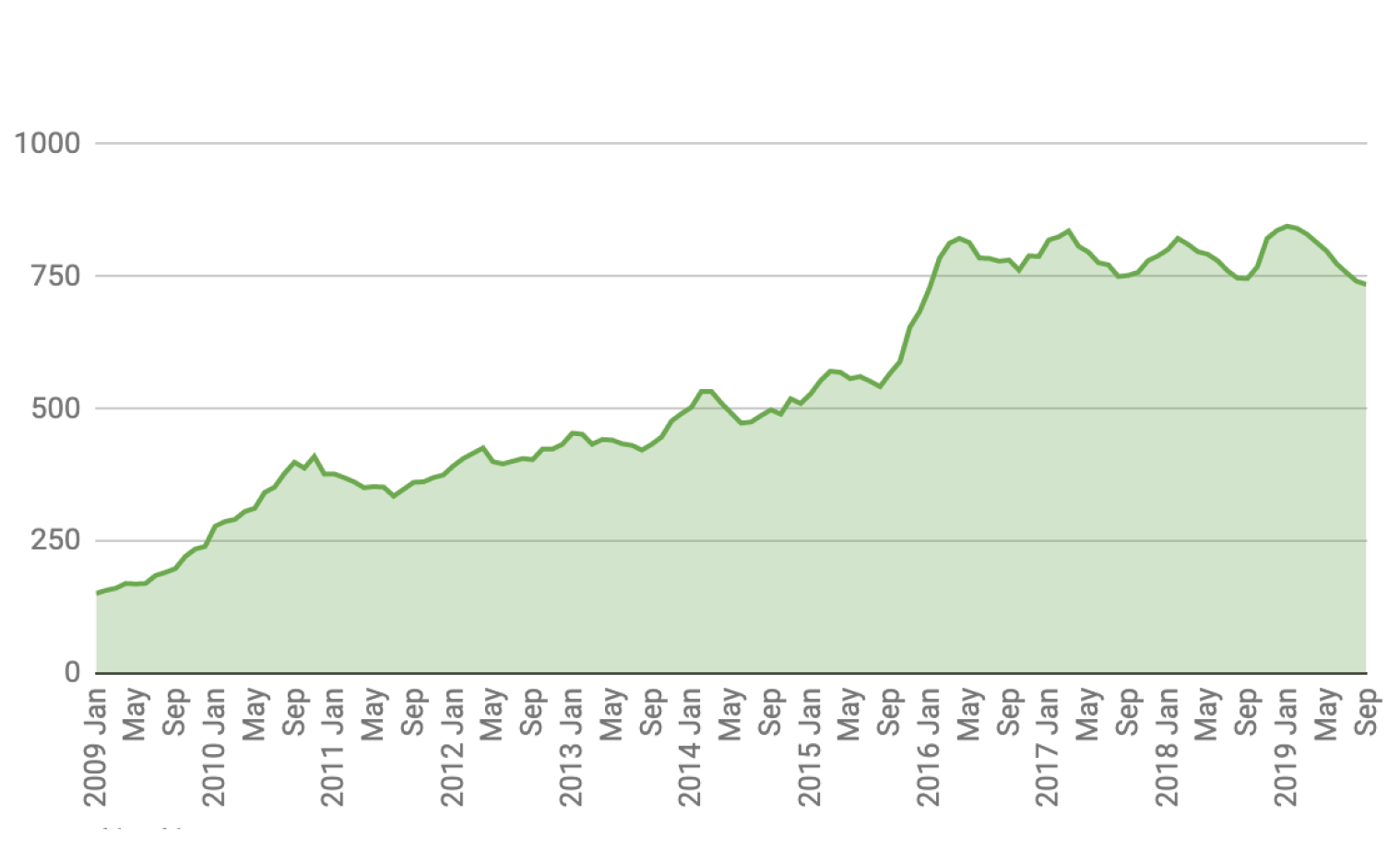

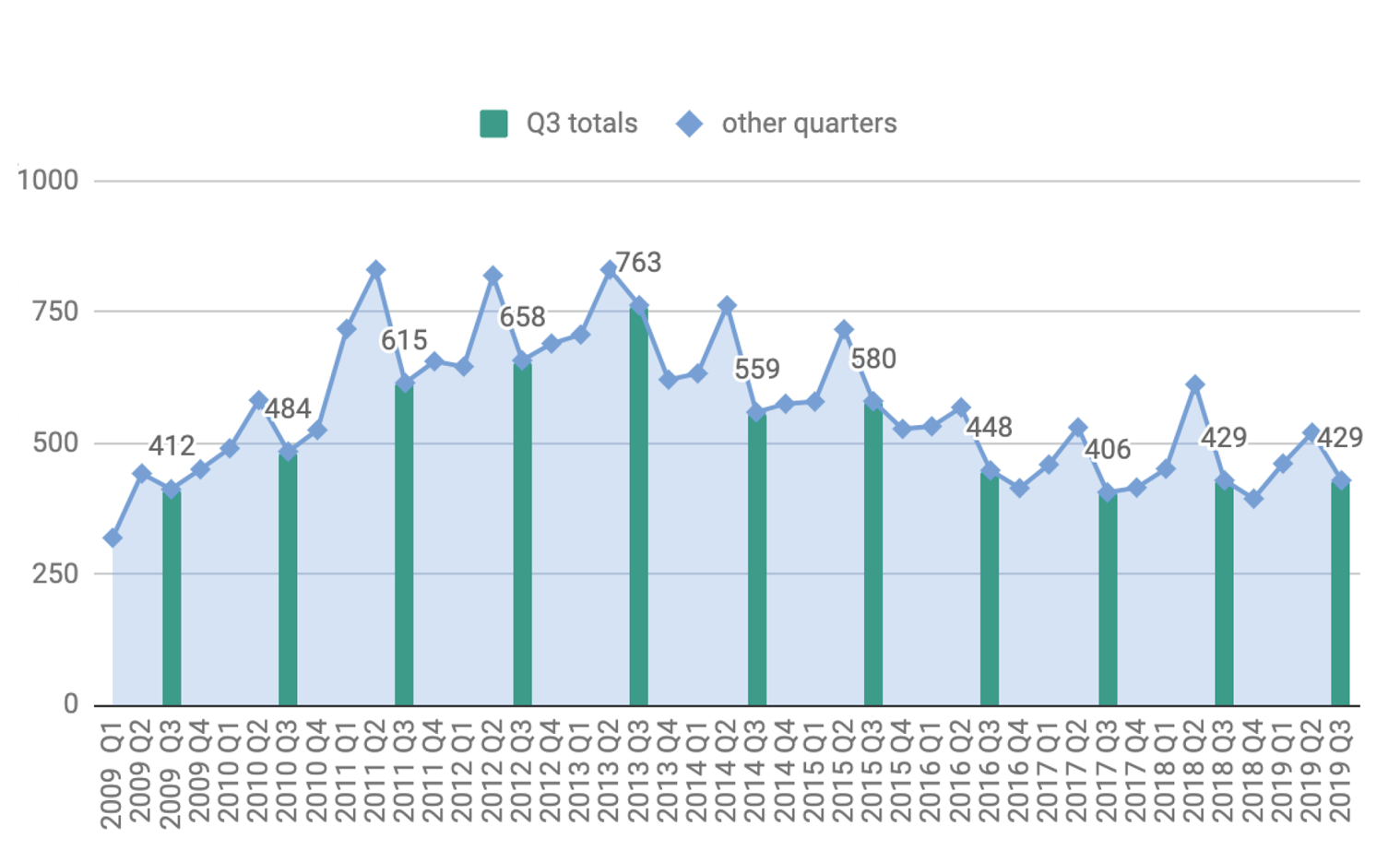

Miami Beach Condos, $1M+.

Transaction volume peaked in 2013.

Q3 2013 vs. Q3 2019

70% increase in supply, 34% decrease in sales.

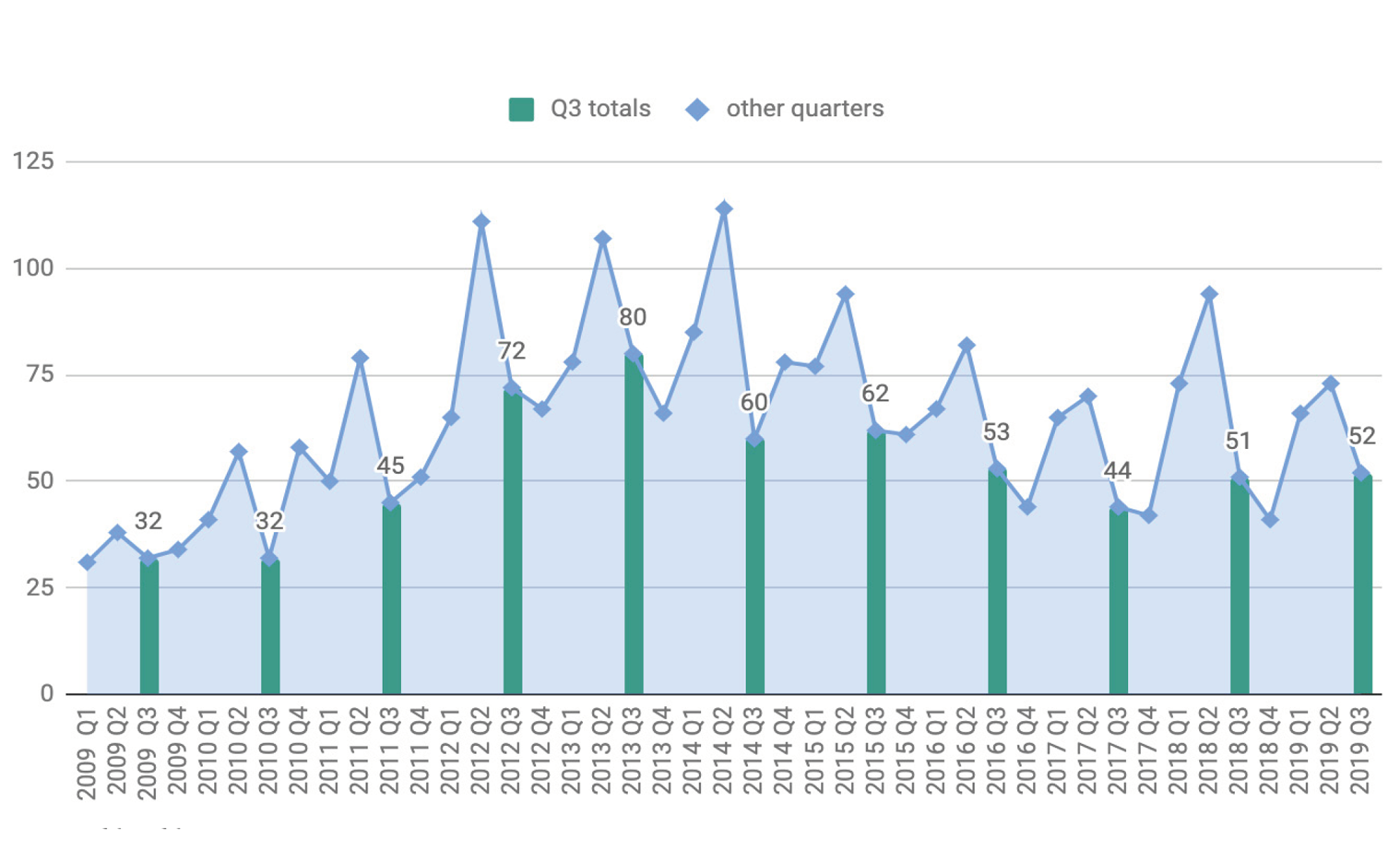

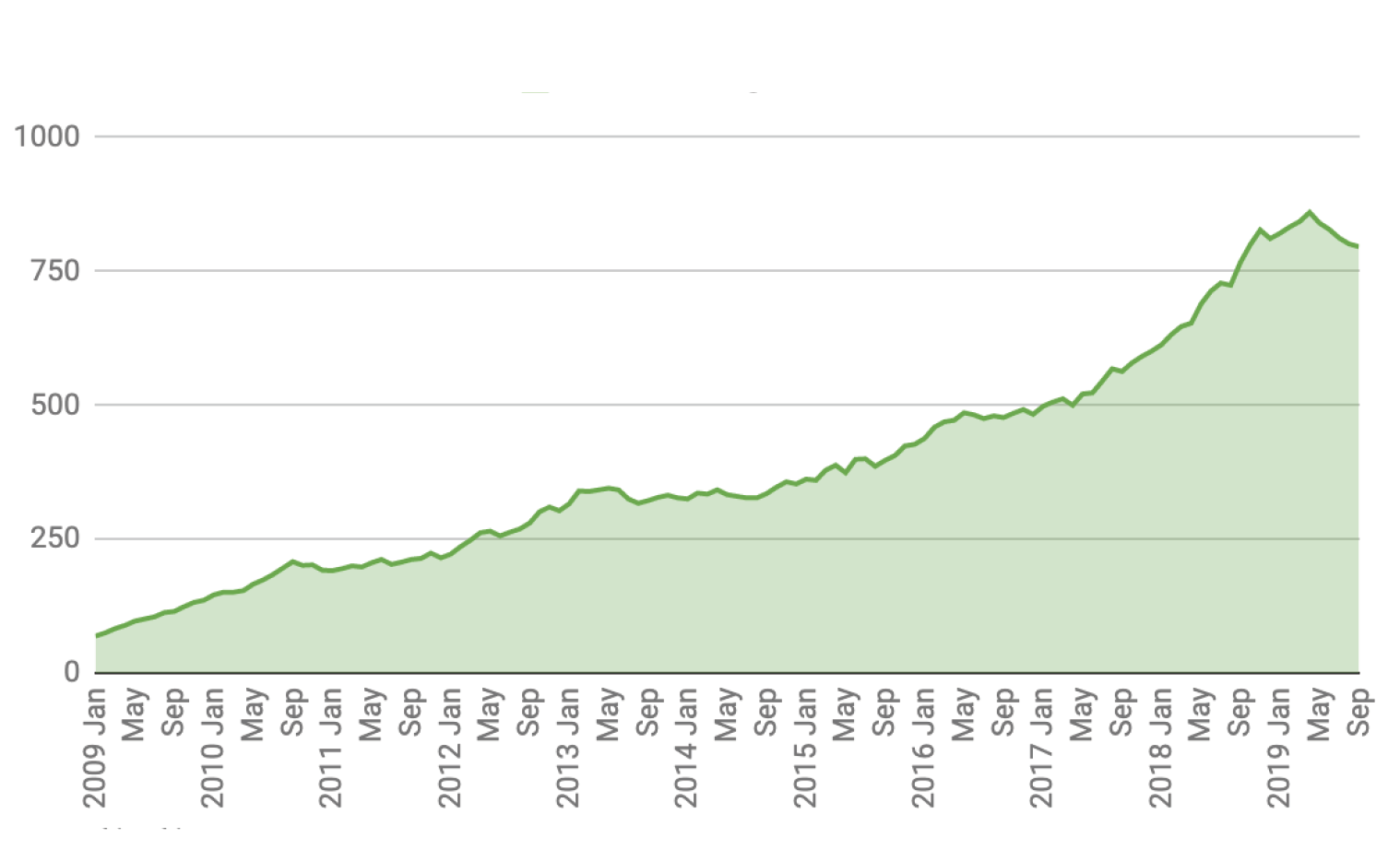

Miami Beach Condos, the entire market.

Transaction volume peaked in 2013.

Q3 2013 vs. Q3 2019

38% increase in supply, 44% decrease in sales.

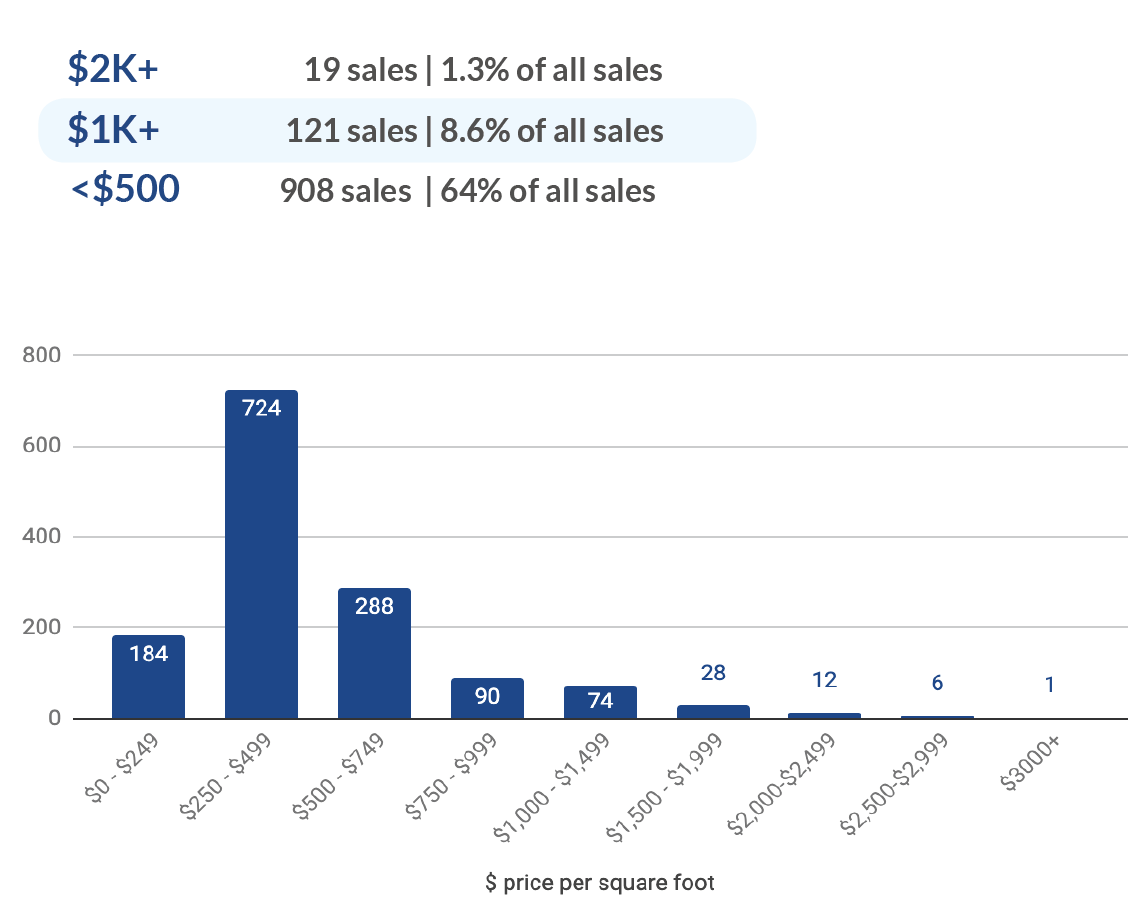

Miami Condo Market through Q3 2019.

Transaction Volume & Inventory Charts.

Charts indicate a substantial supply-and-demand disconnect.

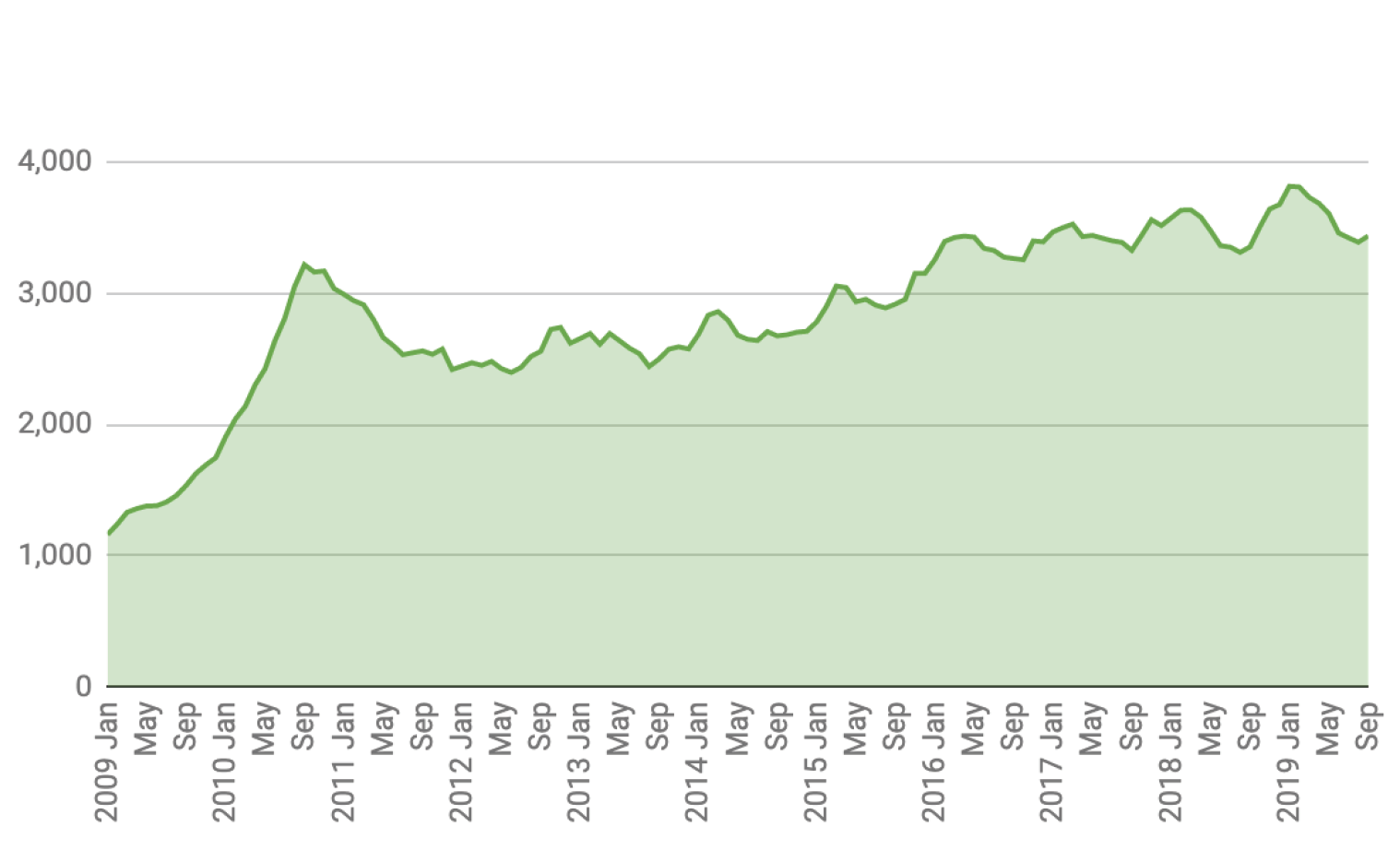

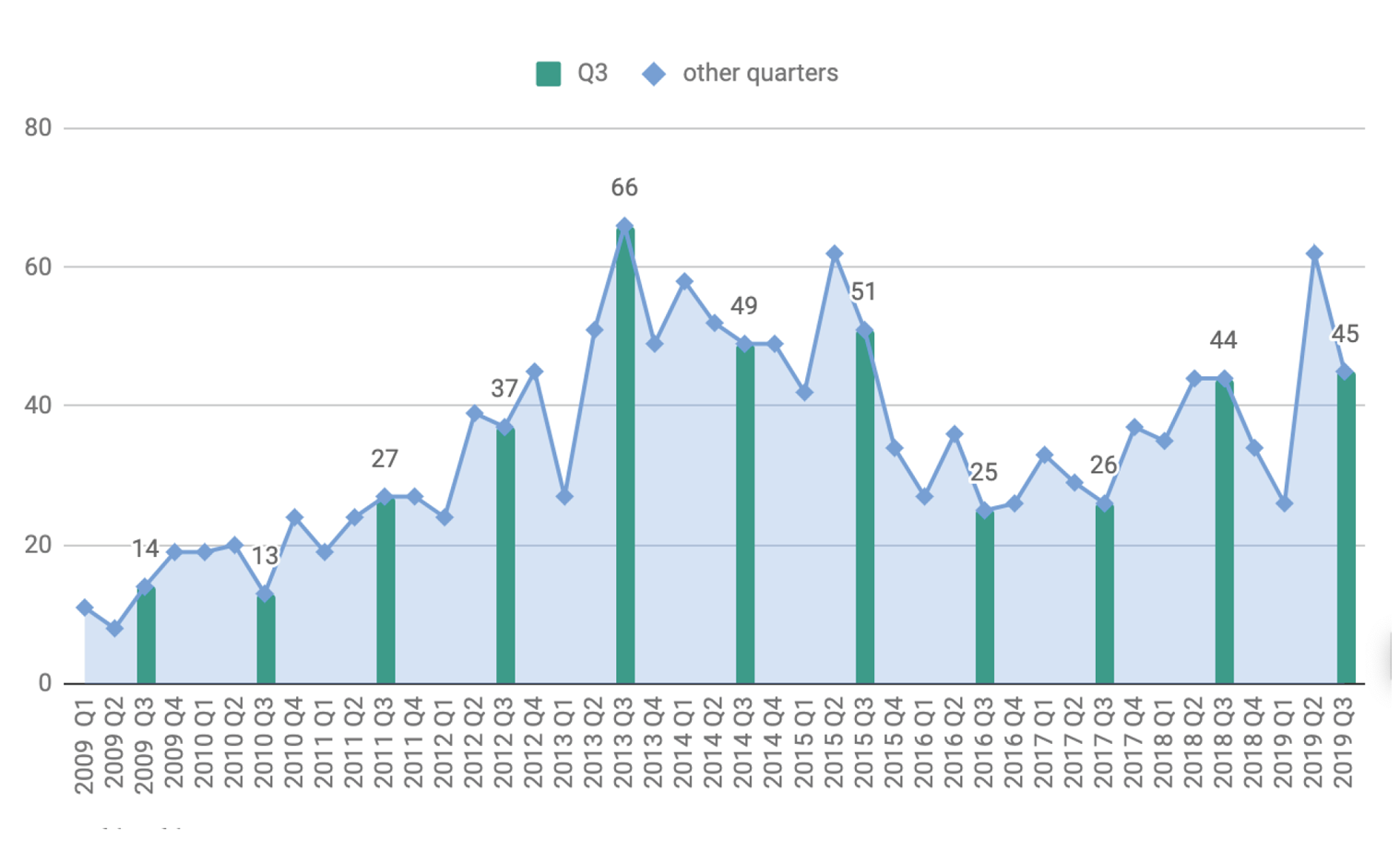

Miami Condos, $1M+.

Transaction volume peaked in 2013.

Q3 2013 vs. Q3 2019

147% increase in supply, 32% decrease in sales.

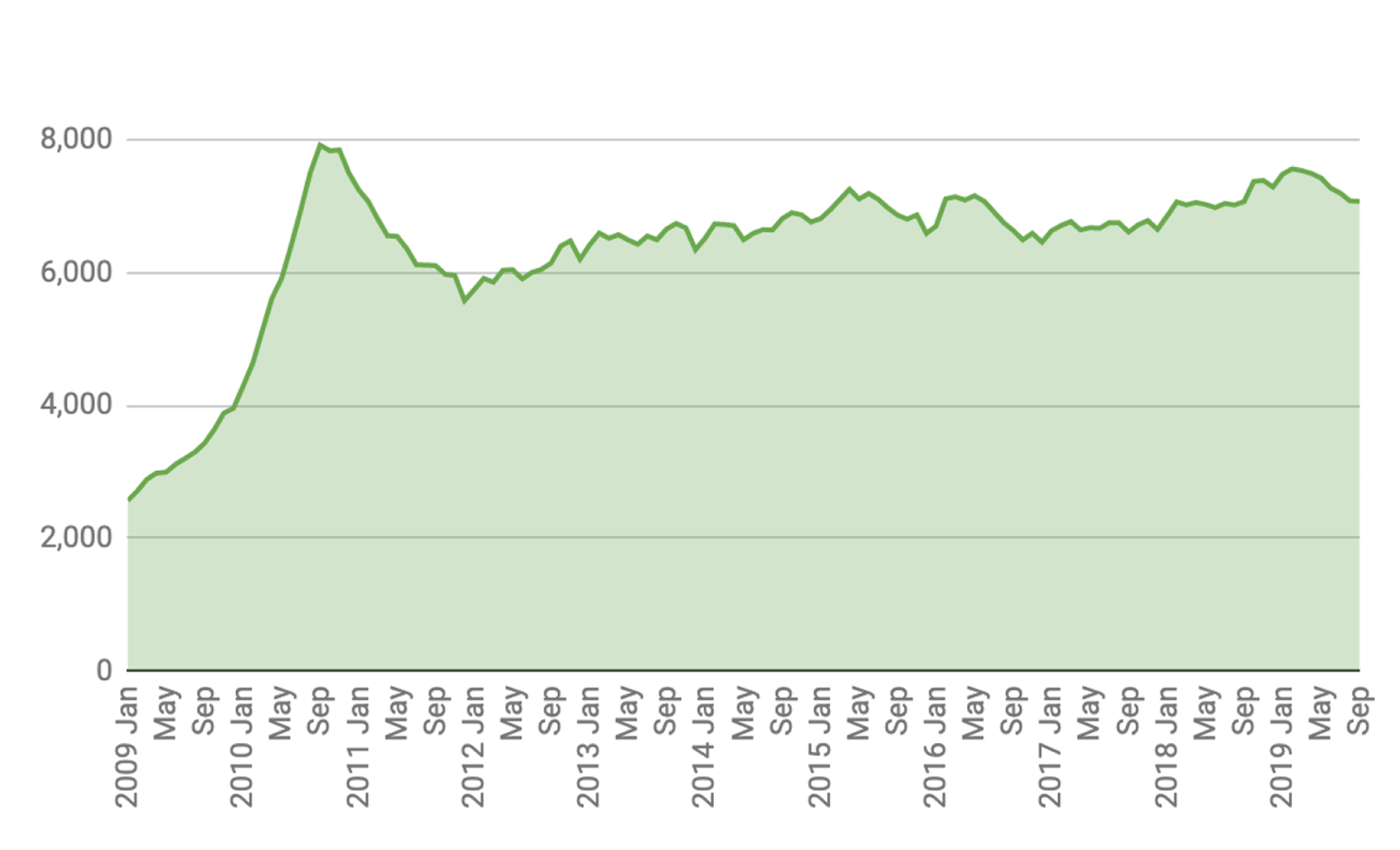

Miami Condos, the entire market.

Transaction volume peaked in 2013.

Q3 2013 vs. Q3 2019

6% increase in supply, 21% decrease in sales.

Great content! Super high-quality! Keep it up! 🙂