There is a fundamental disconnect between supply & demand in the Miami and Miami Beach condo markets. Inventory has steadily risen across market segments, all while transaction volume has dropped off. Higher price points are the worst offenders. The Miami $1M+ market saw a 147% increase in supply since 2013, while sales dropped 32% in the same period

Corona Fuels Widening Wealth Gap in South Florida Real Estate

The corona virus is acting as an accelerator of trends. Among them is America's ever widening wealth gap.

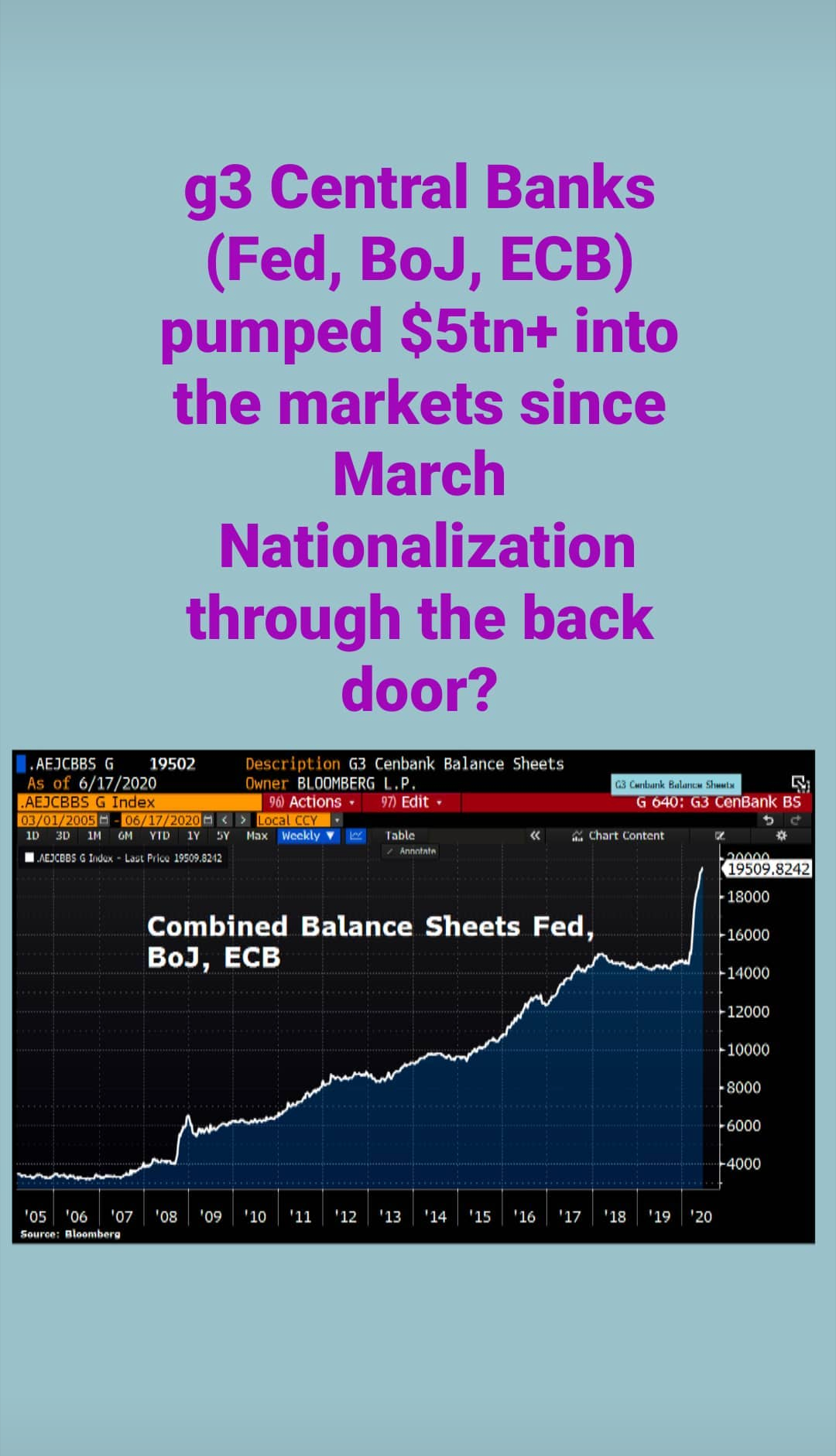

The gap between wall street and main street is widening as the Fed continues to take unprecedented actions, all benefiting the investor class.

In Q2 2020, the divide between wall street and mains street is on clear display in the South Florida real estate market.

In a region full of 50%+ transaction volume drops, some $1M+ single-family home markets saw record high sales volume in June. The $1M+ single-family submarket caters to the investor class. In contrast, previously healthy submarkets with homes in the $300K range, are suffering.

South Florida real estate saw a sharp transaction volume decline in Q2 2020.

The table below shows county-level, single-family home quarterly transaction volume.

Error

You are trying to load a table of an unknown type. Probably you did not activate the addon which is required to use this table type.

You are trying to load a table of an unknown type. Probably you did not activate the addon which is required to use this table type.

While we are seeing broad declines, when we dig deeper, interesting patterns emerge.

The Wealth Gap In Action

Why are $1M+ single-family homes benefitting?

Corona has been an accelerator of pre-existing trends, and this applies to South Florida Real Estate.

The two major Corona-driven trends affecting the South Florida real estate market thus far:

1) The widening wealth gap

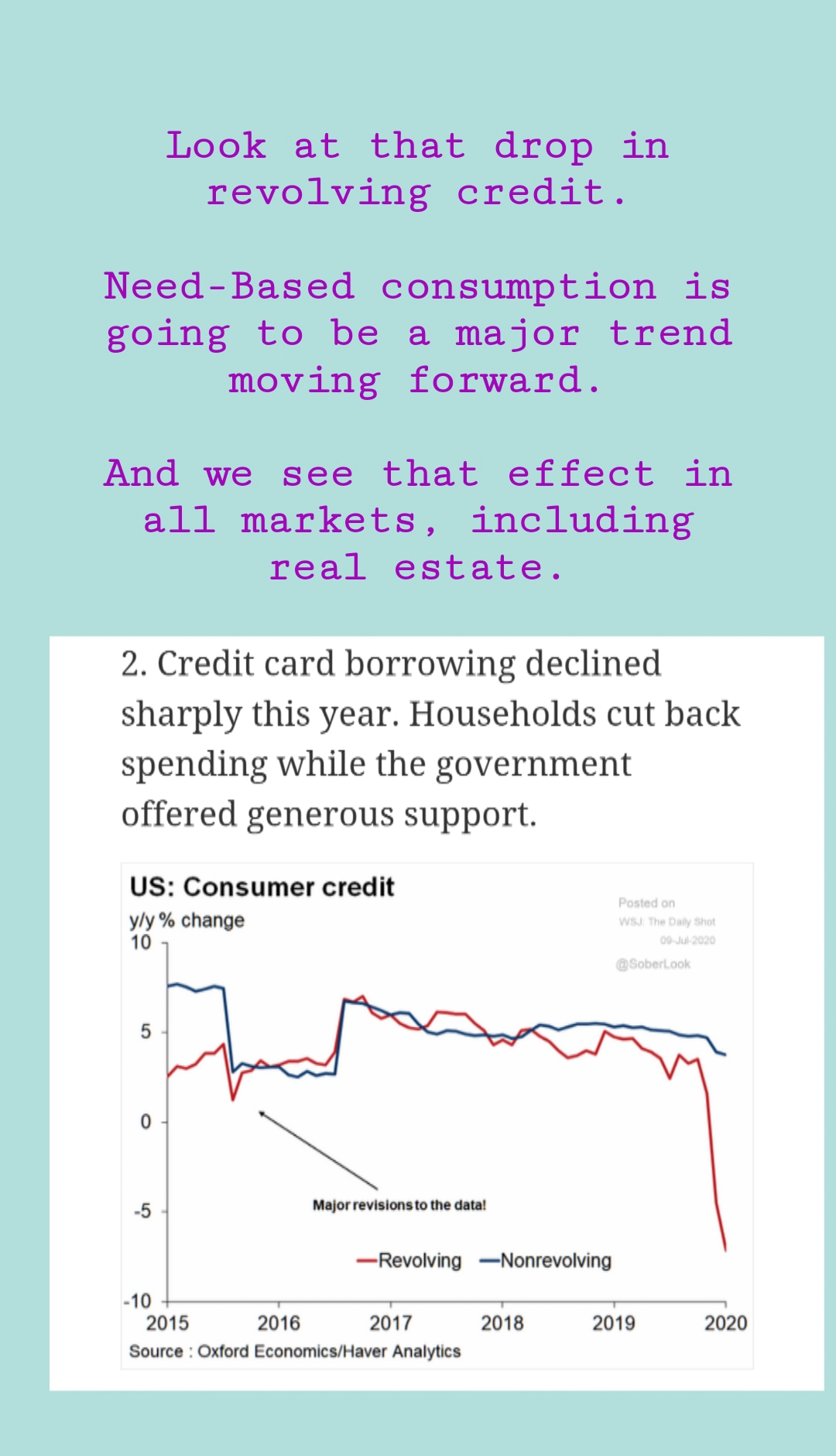

2) The reversion to need-based spending versus

$1M+ single family homes check both boxes

1) They cater to those with financial assets, to people may have benefitted from the Fed’s recent actions to juice the markets.

2) in the current pandemic environment, single family homes can be seen as need based.

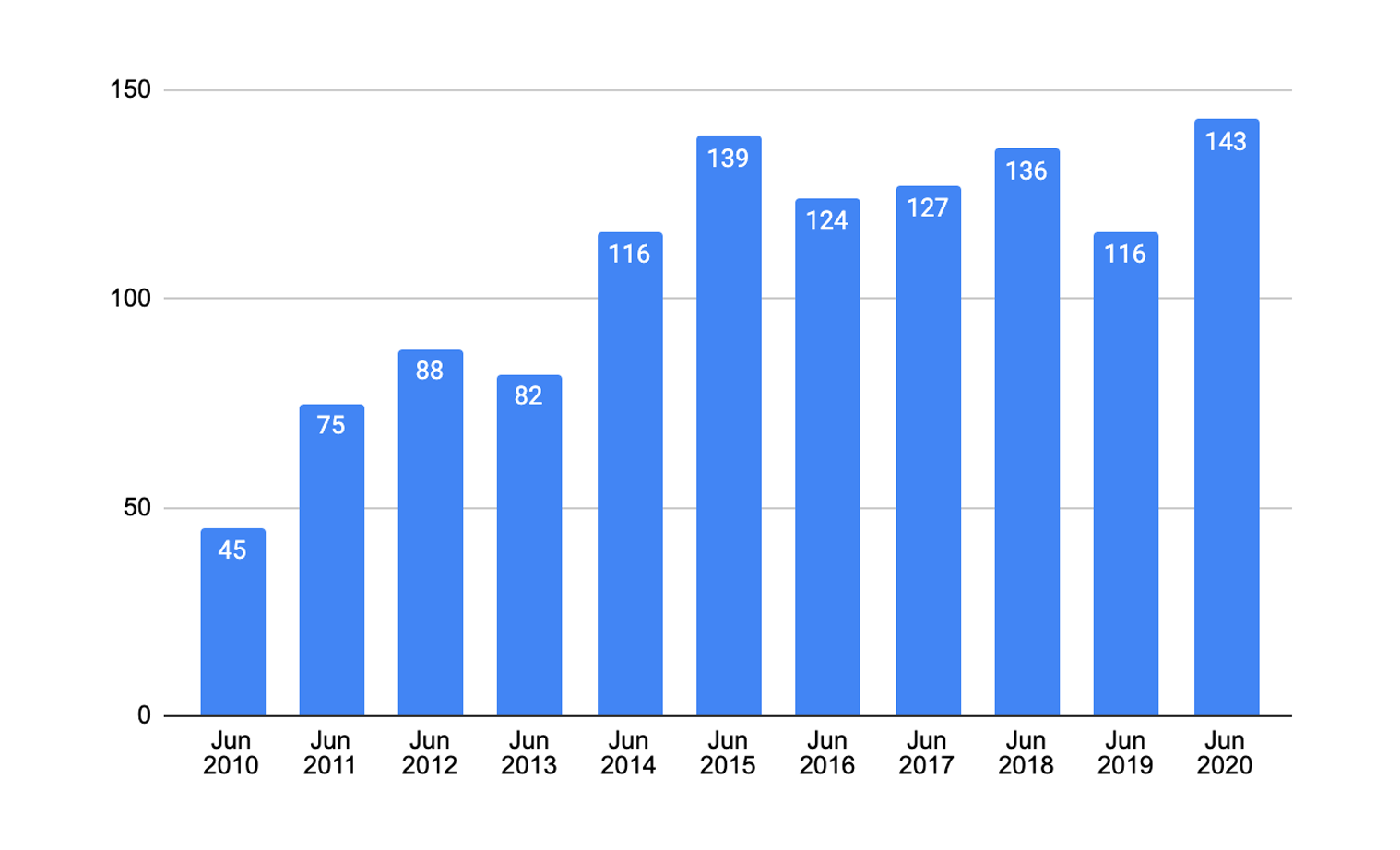

June 2020: record transaction volume, $1M+ single-family homes in South Florida

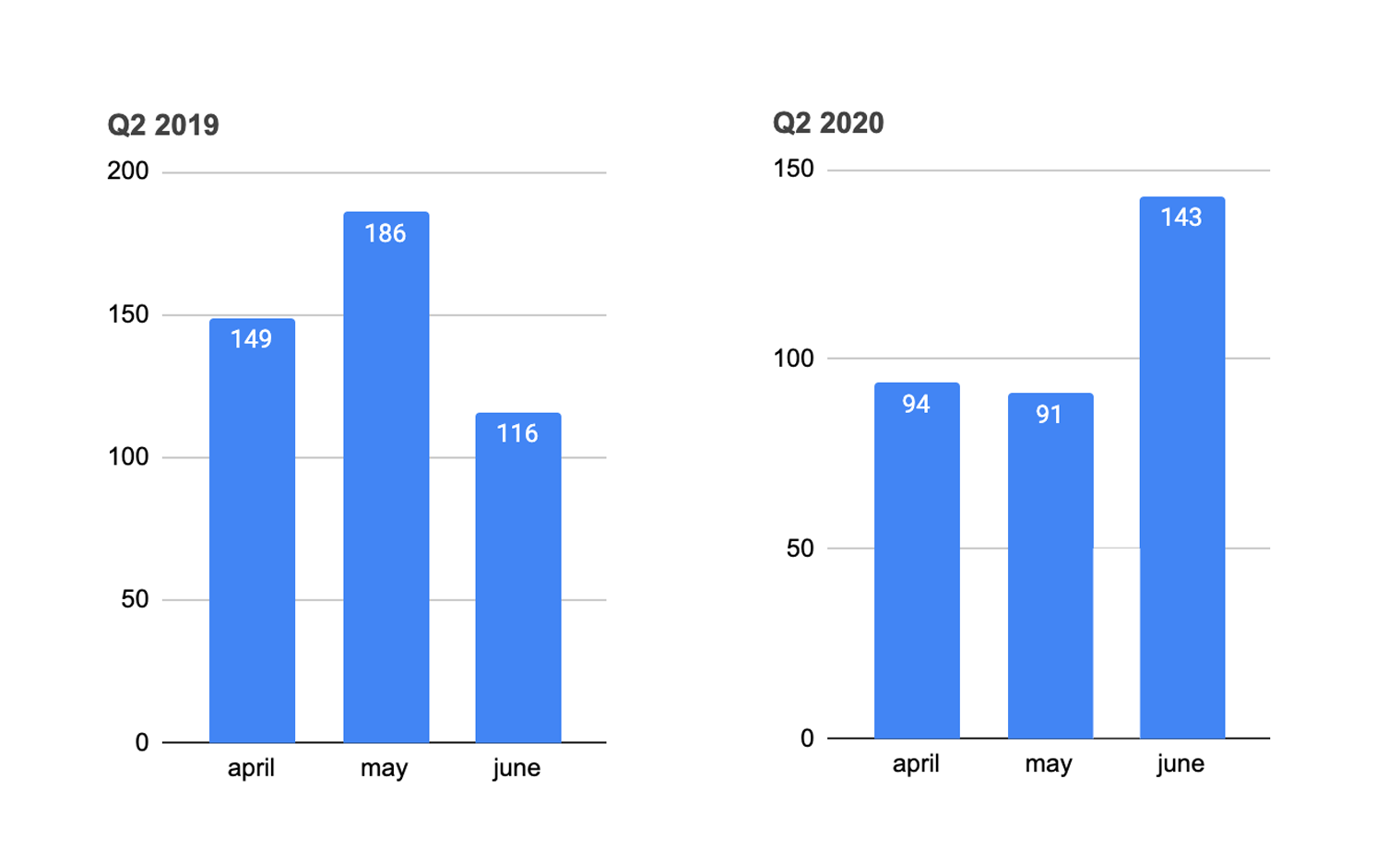

Palm Beach County $1M+ SFH Sales, pre and post Corona

Fort Lauderdale $1M+ SFH Sales, pre and post Corona

Meanwhile, price attainable neighborhoods are suffering

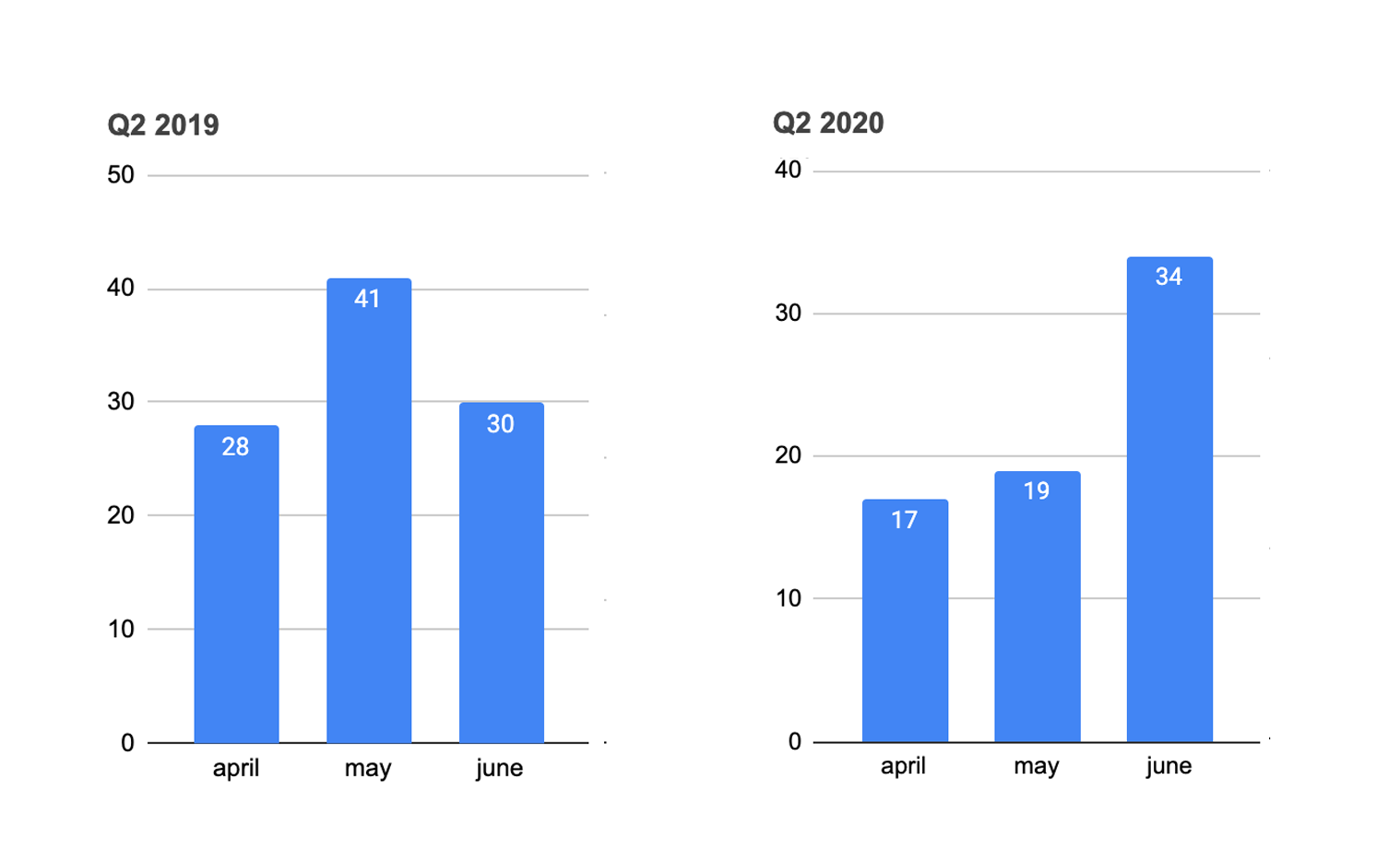

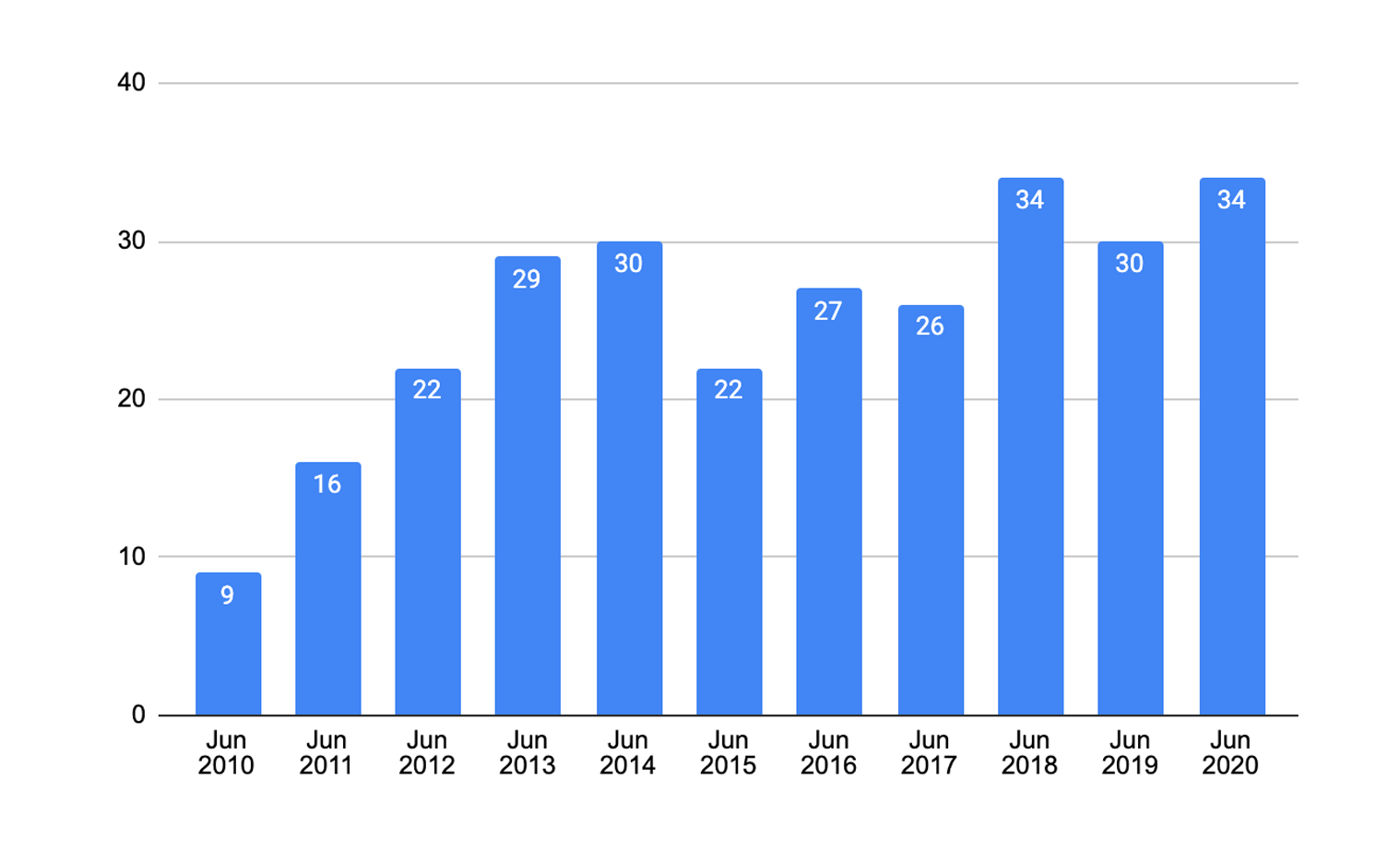

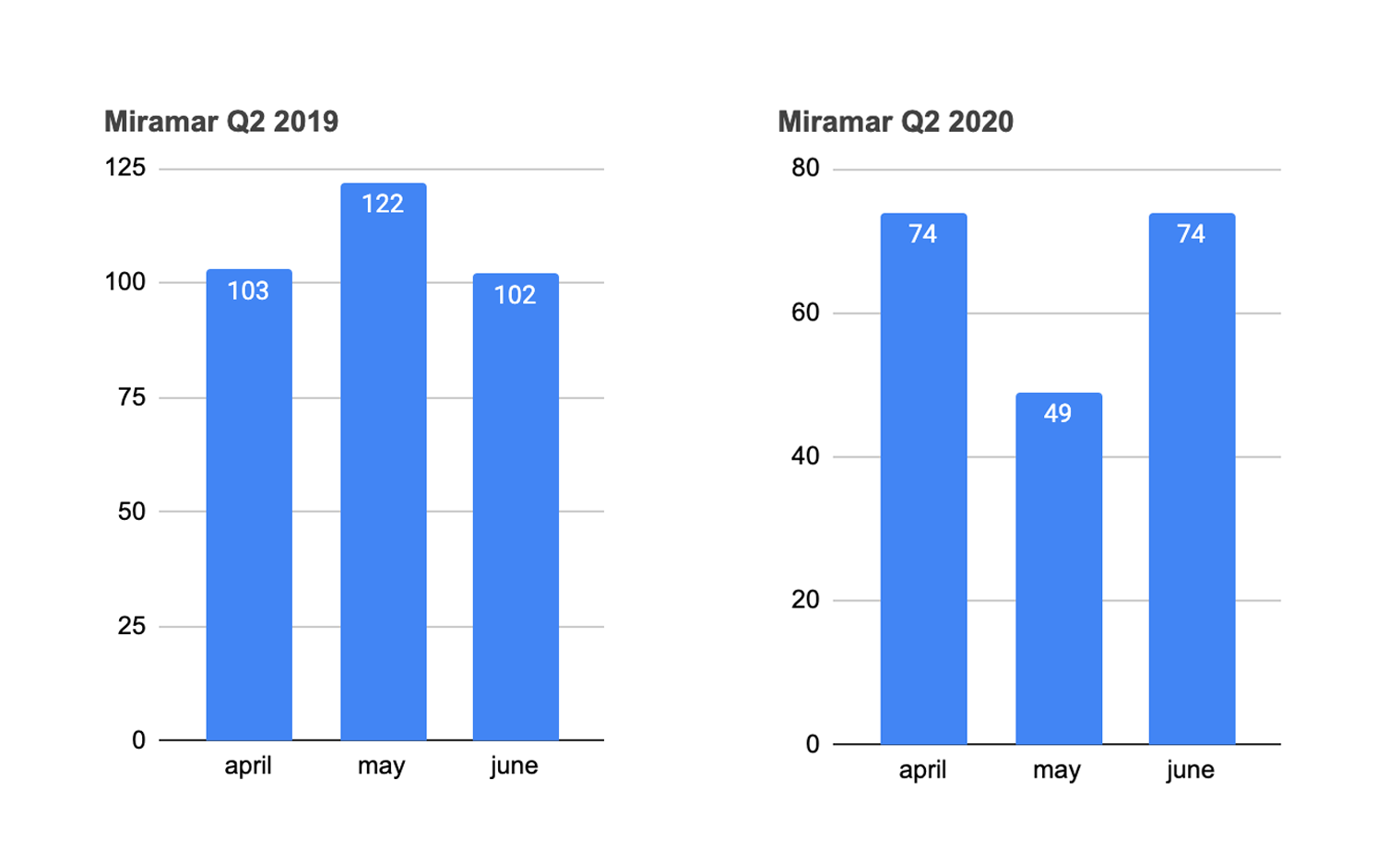

One of the healthiest markets coming into the Corona pandemic were end-user, price attainable areas such as Miramar and Pembroke Pines.

In 2019, houses in Miramar sold for an average of $319K. Houses were flying off the shelves before Corona, with many listings paying out a 5% commission instead of 6% and a 98% close-price to list-price ratio.

Year-over-year, Miramar sales volume dropped 60% in May and was still down 27% in June. Miramara was down 40% for the quarter.

Why is this happening?

Job losses felt at the bottom of the economic spectrum

Actions of the Fed have boosted financial markets, benefiting those with financial assets

40% of low income Americans lost their jobs >

As unemployment benefits run out, and as it becomes clear that many of those jobs are not returning, I see only further acceleration of this unfortunate trend.

A few charts that reveal the reality of our disconnected economy: