There is a fundamental disconnect between supply & demand in the Miami and Miami Beach condo markets. Inventory has steadily risen across market segments, all while transaction volume has dropped off. Higher price points are the worst offenders. The Miami $1M+ market saw a 147% increase in supply since 2013, while sales dropped 32% in the same period

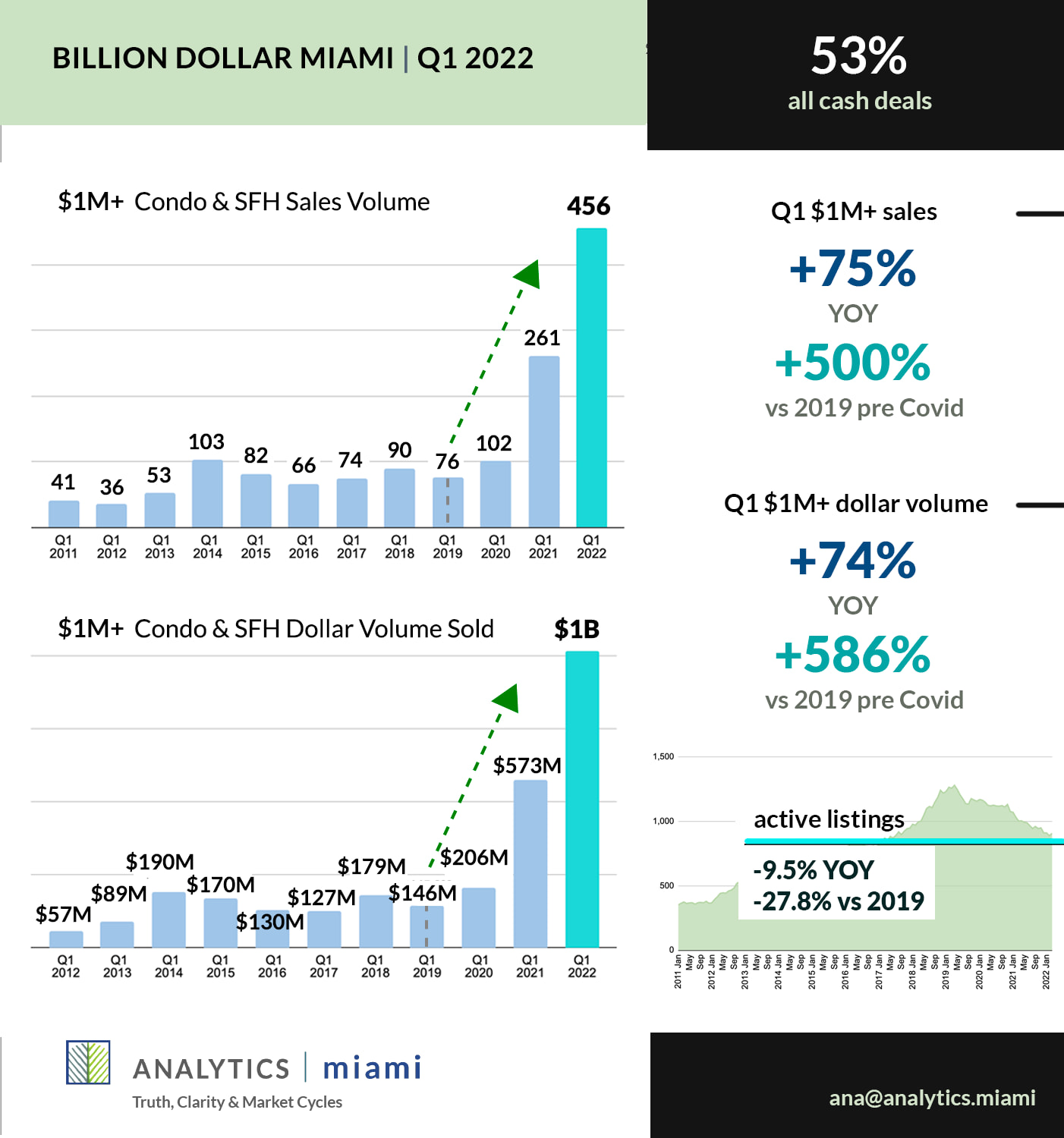

Miami real estate on fire as capital relocates, 9.5x $1M+ condo sales in Q1 2022 versus pre Covid

Focus always shifts, this fact is a constant throughout history.

In the common belief that the present is sacrosanct, people forget this. New York was the capital of the 20th century, post WWII, post Bretton Woods world. Its preeminence is that recent. Think how different the world looked 100 years ago, and now ask yourself, why would the next 100 years be any less dramatically different?

At certain junctures, the shift is rapid and visible to the present-day observer. We are in such a period. The world is shifting as new habits form in the wake of the Covid shutdowns.

Up until the pandemic, we had largely been living with work / life models that were established in the 20th century. These pre-internet habits were sticky, they needed a full-stop event to shake them up. Those that can are now forming new habits, all while the country continues to polarize. Along with new habit formation, the polarization itself is feeding the shift.

The flight of capital and talent continued with no sign of abatement. A major shift in focus is underway.

For many reasons, as outlined in the report and as illustrated by the charts, the flow of capital & talent to Miami has just begun.

I have a working theory that history is the aggregate of human herding behavior over time. Momentum is a real force, and the next 10 years are going to be interesting.

MiamiDealSheet.com - launching soon

The best deals in Miami

Powered by Analytics Miami, hand-picked by Ana

Reports, interviews & feature spotlights

Get on Ana’s List

I personally work with three buyers a month.