Just Released: Analytics Miami 2025 Q4 Report & Forecast Themes of the week: Wealth Migration • 2025 Q4 Report & Forecast • New Interviews Wealth migration is the theme of the week, and will be the theme of the century. Global HNWI relocations reached record levels in 2025 and still increasing into 2026. Within the United States, a clear trend persists: high value tax payers are relocating and our feeder jurisdictions are predictably increasing their hostilities to capital. The net effects of California billionaire tax are obvious. Recall that Bezos moved to Miami when his home state proposed a wealth tax. He would have accounted for 45% of the theoretical revenue. Today I read that the Netherlands is likely to start taxing unrealized capital gains at 35%. One starts to wonder what these regimes may start doing to curtain inevitable exoduses. Wealth mobility is real. Miami's emergence as a destination for wealth is evident in the year-end and Q4 numbers.

Miami Real Estate: new normal past $1K / square foot

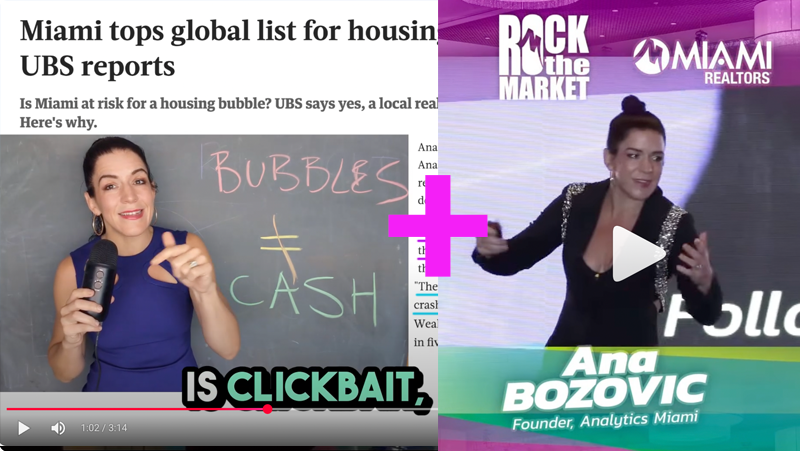

There is a great deal of talk in the press about drops in residential transaction volume. Suffice it to say, some nuance is missing, as is cyclical context.

Let's recall my commentary last week regarding Miami's mythical two year population drop, a fabrication that a lot of press keeps repeating. It seems that negativity gets clicks.

Regarding transaction volume, it is important to recognize:

Despite overall drops in transaction volume, market segments past $1K & $2K per square foot are outperforming pre Covid levels by up to 9x. This is something I find fascinating, and indicative of many trends.

-> The market is not a monolith. The vast majority of transactions are at lower price points. When we look at the overall percentage drop in sales volume, the action (or lack thereof) at lower price points obfuscates what is happening at higher price points.

-> A new normal is being set past $1K / square foot, this reflects the appetites of the incoming wealth & talent migration. Isolating by price-per-square foot lets us filter for new product. We clearly see that the incoming wealth and talent migration is consuming new, expensive product. This is also a reflection of America's ongoing polarization and our shift away from 20th century epicenters.

Example:

In Miami-Dade, sales of SFH past $2K / SF were up 650% Q2 2023 versus Q2 2019, pre Covid. This stat ties in to a theory I discussed in my interview with Karen Asprea, where I discussed how buying SFH within the precepts of Miami's urban core is like locking in land value with a townhouse in NYC 80 years ago.

The pattern holds when we look at aggregate tri-county data, and holds across Palm Beach, Broward and Miami-Dade counties.