Feb 2026 General Market Update • Market Opportunities • Billion Dollar Miami Tour With Cristiano Piquet • Ana on Jay Roberts The Long Game General market update, February 2026: Miami Dade median SFH price: $685K, up 5% year-over-year Miami Dade median Condo price: $415K, down 8% year-over-year Condos built post 2010, median price: $715K, up 15% year-over-year, and at an all time high. This illustrates the divide in performance between new and old condo inventory. Given that Miami now has the highest concentration of millionaires in the nation, we can expect a to see ongoing market divergence. Segmentation is critical.

Show Me The Money: all cash buying percentages across South Florida real estate

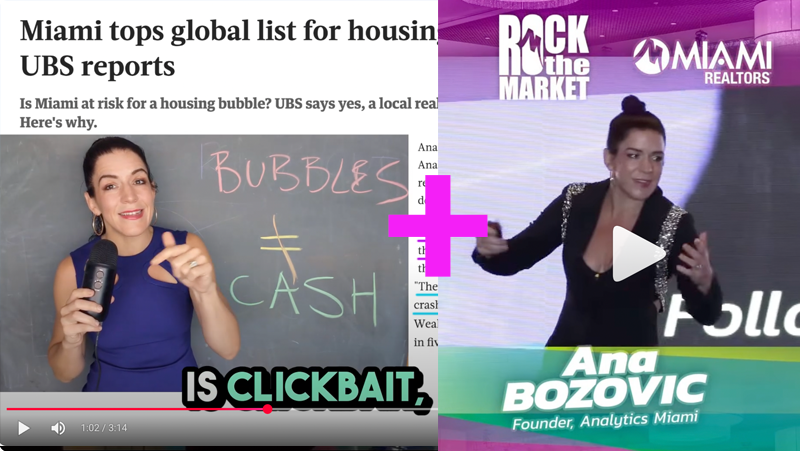

As data keeps coming in corroborating the South Florida & Miami story, various news outlets continue to publish unsubstantiated clickbait to the contrary. I have been seeing stories lately about “bubbles” and “froth”.

The question bears asking: what is a bubble and how / why do they pop?

Asset bubbles are almost always the result of irresponsible usage of easy debt. When the underlying assets can no longer support the debt, prices quickly collapse. And in retrospect, we define said phenomenon as a bubble bursting.

Show Me The Money: A cash market is very unlikely to exhibit bubble-like behavior and it has a solid floor.

The South Florida market is very heavy on cash.

See below for a video and for charts with the whole breakdown.

You may find the reality to be a bit shocking in some cases.

I published this now because the Fed just lowered rates, so if we break down the whole market we can see which segments stand to benefit & which have been 90% cash all along

Download my full Q2 2024 Miami Real Estate Report

And also note that nationwide:

-> 98% of mortgage debt is fixed rate

-> almost 40% of homes have no mortgage at all

This is not at all the same setup as we had in the previous cycle.

===

A few of the recent stories corroborating the ongoing wealth & talent migration & SFH scarcity point I keep talking about:

1) As published in the South Florida Business Journal on Sept 27, 2024:

Blackstone has surpassed 250 Miami employees at its Miami office & plans to add more.

2) Anand Khubani paid $100M for a waterfront assemblage on La Gorce Island. This is now the most expensive purchase in Miami Dade for the year. The deal should close soon, and it showcases once again the value & inherent scarcity of prime SFH parcels.

3) Henley & Partners, a leader in residence and citizenship by investment, has published a report on the Centi-Millionaire boom and their movement. Miami leads the list as the top destination and is among world leaders for projected Centi-Millionaire growth (2024-2040). Other Florida cities also feature prominently, indicating regional strength.

The breakdown of all-cash buyer percentages, by various segments of the South Florida & Miami real estate market is here:

A section of the Henley & Partners report is below.

The Henley & Partners report on Centi-Millionaires is here >

Get on Ana’s List

I personally work with a select number of buyers every month.