Miami Real Estate Market Analysis

Videos, trend analysis &

special situations in Miami real estate.

2026 Reports and Videos

2025 Q4 Miami Real Estate Market Report: Release & New Interviews

Just Released: Analytics Miami 2025 Q4 Report & Forecast

Themes of the week:

Wealth Migration • 2025 Q4 Report & Forecast • New Interviews

Wealth migration is the theme of the week, and will be the theme of the century.

Global HNWI relocations reached record levels in 2025 and still increasing into 2026. Within the United States, a clear trend persists: high value tax payers are relocating and our feeder jurisdictions are predictably increasing their hostilities to capital. The net effects of California billionaire tax are obvious. Recall that Bezos moved to Miami when his home state proposed a wealth tax. He would have accounted for 45% of the theoretical revenue. Today I read that the Netherlands is likely to start taxing unrealized capital gains at 35%. One starts to wonder what these regimes may start doing to curtain inevitable exoduses.

Wealth mobility is real. Miami’s emergence as a destination for wealth is evident in the year-end and Q4 numbers.

2025 Reports and Videos

UBS Clickbait Bubbles, Rock The Market Clips & Special Invitations

Themes of the week: UBS “Bubble” Report • Rock The Market Highlights • Special Invitations.

Thank you to the South Florida Business Journal for quoting me on this topic. The UBS “Bubble” report is a travesty and they should be embarrassed. This report a sensationalist misuse of a global platform, and its misleading headline is being echoed by press worldwide.

* An invitation: Join me, I am speaking at the Real Deal Conference.

📍 Mana Wynwood | November 5 & 6

I am speaking on Nov 6 in a first-ever, special debate style panel with Daniel Kodsi.

https://events.therealdeal.com/event/how-to-survive-the-squeeze

* An invitation: Join me for my super fight at Main Character Jiu Jitsu

📍 La Scala De Miami Brickell | October 19

Tickets here, please select me at checkout:

https://nitrotickets.com/event/1064/MCJJ-1HALLOWEEN-1HAVOC-1–11019

September 2025 Miami Real Estate update: Fed rate cuts & Ana Bozovic on Fox News Live

The Federal Reserve just cut rates by 25 basis points, with Powell signaling that two more rate cuts are possible by the end of the year.

What does this mean for Miami real estate?

The net effect of this will be an increase of monetary flow into the market.

Meaning: more money and participants will enter the Miami market.

Watch Ana Bozovic’s Fox News segments where she touches upon the future of Miami real estate and what is driving the flow of money to the region.

Q2 2025 Miami Dade Real Estate Report & Ana Bozovic Speaking at Inman Miami

I hope you enjoy the release of my Q2 2025 Miami Dade Real Estate Report.

This post also includes video segments of Ana Bozovic’s Inman Connect 2025 talk at New World Symphony in Miami Beach. The segments will help to contextualize and bring to life the Q2 2025 market report.

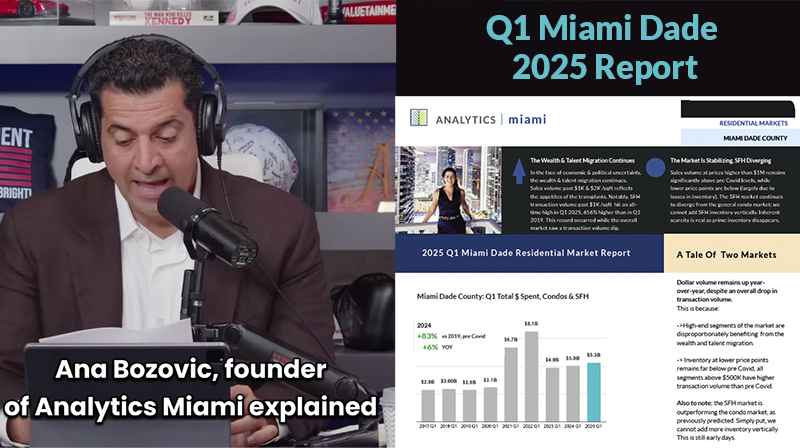

Q1 2025 Miami Dade Real Estate Report

Thank you Peter Santanello for shooting an episode with me:Inside Wealthy Miami – Why Are So Many Americans Moving Here?

Thank you Wall Street Journal for using my data and quoting me in this excellent article: Million-Dollar Homes Skyrocket in Miami, as Starter Properties Go Extinct.

Miami Dade Real Estate: March 2025 Update

Thank you Peter Santanello for shooting an episode with me:Inside Wealthy Miami – Why Are So Many Americans Moving Here?

Thank you Wall Street Journal for using my data and quoting me in this excellent article: Million-Dollar Homes Skyrocket in Miami, as Starter Properties Go Extinct.

Miami Dade Real Estate: January 2025 Update

January has closed out in Miami. How are the markets behaving so far in 2025?

The tail of two markets continues to play out.

-> sales volume of both SFH & Condos past $2K / square foot are up year-over-year, clocking in record transaction volume for the month of January. In Jan 2019, there were ZERO SFH sales past $2K / sq ft. Things can change quickly. New product at prime locations (especially end user product) is likely in under supply.

-> the extinction of SFH below $500K continues.

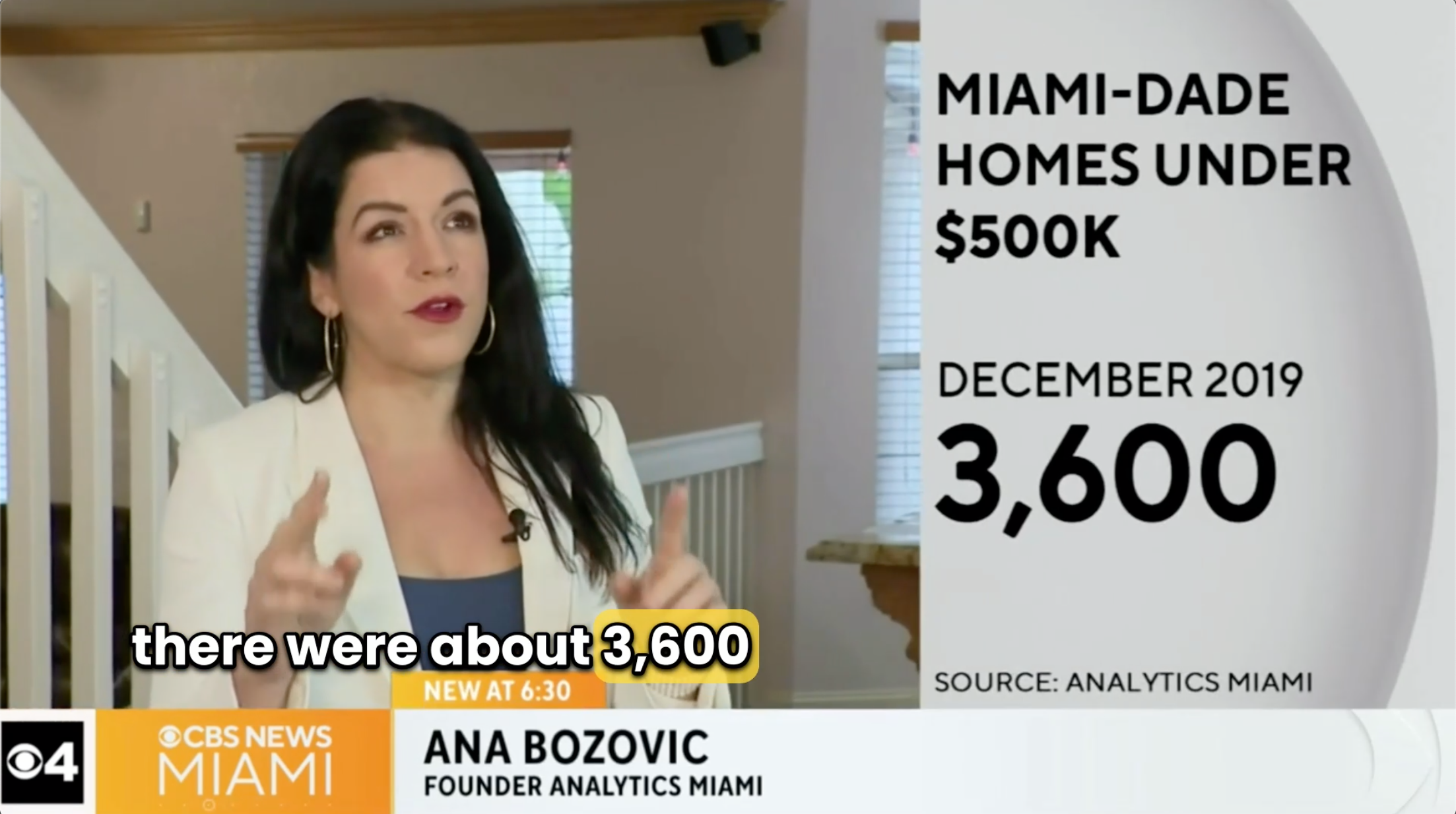

Active listings (inventory) in Miami Dade < $500K in January 2025: 640.

Active listings (inventory) in Miami Dade <$500K in January 2019: 4,452

We are down 86% vs. pre Covid in 2019. This is the extinction of a price point.

Just released: Miami Dade 2024 annual report & 2025 forecast!

Just released!

My 2024 annual Miami Dade real estate report is now live!

Uncover Miami’s hottest real estate trends & opportunities.

Highlights:

–> New product at prime locations continues to shine: we actually don’t have enough.

Both condo and SFH transaction volume was up YOY past $1K / sq ft.

SFH past $1K /sq ft hit an all time high and is up a remarkable 631% vs. 2019 (pre Covid)

–> Despite fake, alarmist press headlines: Miami Dade overall inventory levels remain below 2019 (pre Covid) levels

–> Speaking of inventory levels, this is truly shocking: Miami Dade SFH active listings below $500K are down 800% vs. 2019 pre covid.

There are now only about 600 active SFH listings sub $500K in all of Miami Dade County.

Pre Covid in 2019, there were over 3,500.

I think the implications of this are obvious. And far reaching.

Hot off the presses! Miami Dade SFH 2024 report preview

Hot off the presses!

Miami Dade SFH 2024 report preview. Full 2024 year end report and 2025 forecast coming next week.

Median price at all time highs, inventory 36% below pre covid (2019).

This should provide plenty of ammo to retort the negative, click bait generated by legacy media.

Annual data is simple to understand and the truth is clear.

2024 Reports and Videos

NEW CENSUS DATA: blue states continue to lose population!

I made the table after downloading and processing newly released 2023 interstate census data.

Source: https://www.census.gov/newsroom/press-releases/2024/state-to-state-migration-flows.html

The pattern is very clear.

High tax, blue states are losing population due to interstate migration.

And as I keep saying, I do not see this reversing.

I do not see a sudden net flow into high tax states.

The political leanings of the state seem to be correlated to the tax levels.

My study was picked up twice by the Daily Mail.

https://www.dailymail.co.uk/news/article-14055047/US-map-fastest-growing-states-census-population.html

https://www.dailymail.co.uk/yourmoney/article-14198061/florida-arizona-cities-baby-boomers-travel-packs.html

The pattern is very clear.

As the country reshapes around 21st century realities and shift in economic focus continues, high tax states are clearly losing population.

Ana Bozovic Refutes Newsweek, yet again

Legacy media has dug its own grave.

Completely false headline again, accompanied by a very poorly written story.

The arrogance with which legacy media lies and creates poorly written, politically motivated hit pieces is breath taking.

And this is my second time refuting a Newsweek article.

I had previously debunked a Newsweek article in July, 2024.

Trump won. What does this mean for Florida & Miami real estate?

Trump won the election, what does that mean for South Florida & Miami real estate?

Journalist Brian Bandel asked me that question the day after the election. And this is what I told the South Florida Business Journal:

“Given the team that he has assembled, most notably Elon Musk, I believe that a Trump presidency will be aligned with entrepreneurs and creators,” Bozovic said. “Since South Florida is attracting tax payers and creators, our housing market will be further super charged by an administration that fosters entrepreneurship.”

And I stand by every word of that. Furthermore, I feel that a subconscious pause has been lifted in the aftermath of the election. The next wave forward is about to commence.

And note: I am compiling October numbers. As per my thesis, the SFH market continues to hit all time highs. End user product within proximity of the urban core is a strong play.

2023 Intrastate Migration Numbers Released by the Census: TX & FL winning

2023 Intrastate migration numbers are in, just released at census.gov.

Rather unsurprisingly, the post Covid trend continues. TX & Florida are once again #1 & #2 when it comes to net intrastate migration gains.

* Blue states, that tended to be high lock-down & are high-tax, keep losing population. (This is an observation, I am a registered independent). The top five population losers were all blue states.The two winners (TX & FL) have no state income tax. The two biggest two losers (CA & NY) have among the highest levels. I do not report on this with any personal joy, I grew up in NYC. It is what it is.

Ana Bozovic Debunks Business Insider

I released my official Q3 2024 Miami Dade report last week.

All of the Miami and South Florida numbers were fresh in mind.

I happened to come across an article in Business Insider that made the bold statement:

“Home-listing prices are down as much as 12% in boomtowns in Florida, Texas, and other popular states”

The article then lists Miami as #1, with a 12% drop in list prices.

This is absolutely not true. Not even close. This is honestly mind-blowing.

I caught this because I am an expert in this field. And in all honestly, this makes me seriously wonder what else is completely false.

Q3 2024 Miami Dade Real Estate Report: Official Release

Officially live: Ana Bozovic’s Q3 2024 Miami Dade Real Estate report!

Segments catering to the wealth and talent migration continue to outperform pre Covid realities by a wide margin, with some segments at all time highs.

Ex: SFH past $1K /sq ft transacted at record levels Q1-Q3 of 2024. And most market segments above $500K saw YOY sales volume growth (all SFH segments and some condo).

Actionable value is found when drilling down, but the macro drives the micro. We need to understand the basis of the market and the fundamental trends driving what we see in the numbers. Starting there, we can then drill down further in order to make predictions on specific sectors.

Q3 2024 Miami Real Estate Report Preview

Q3 2024 has just closed out! The data continues to trickle in. I will have my full Q3 report ready for you next week. Today I would like to share a preview of some of the initial findings.

Spoiler alert: the #LongMiami and South Florida thesis keeps playing out.

Segments successfully catering to the wealth & talent migration:

-> New product in prime location.

-> Throw in in inherent scarcity, and you get the phenomenon that is our high-end SFH market.

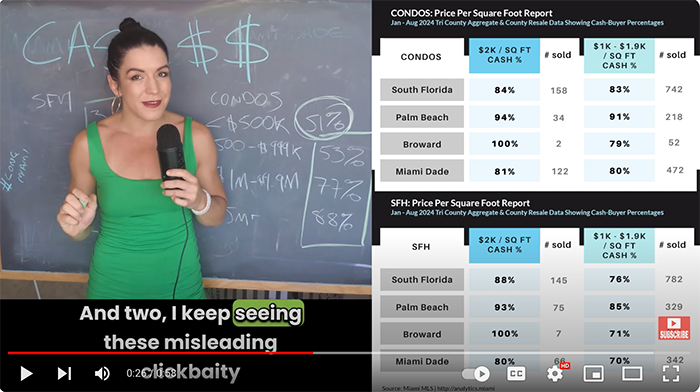

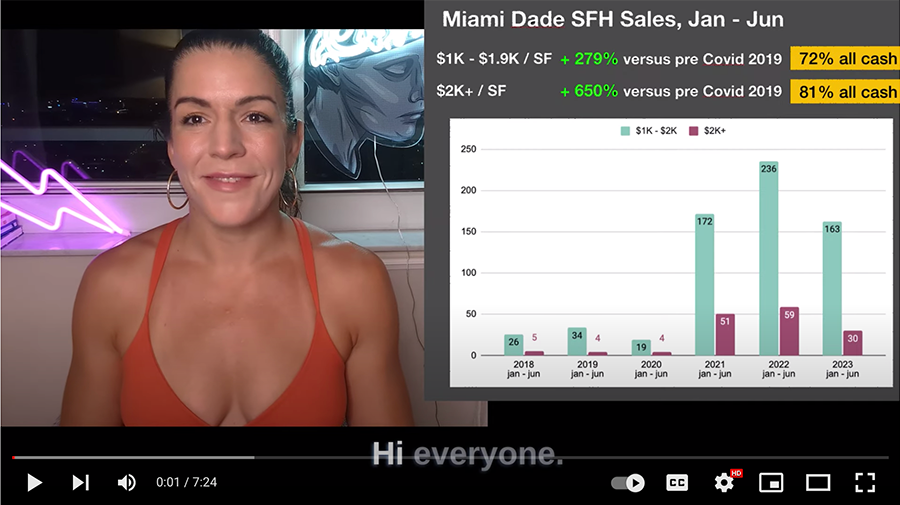

Show Me The Money: all cash buying percentages across South Florida real estate

Show Me The Money: A cash market is very unlikely to exhibit bubble-like behavior and it has a solid floor. The South Florida market is very heavy on cash. As data keeps coming in corroborating the South Florida & Miami story, various news outlets continue to publish unsubstantiated clickbait to the contrary. I have been seeing stories lately about “bubbles” and “froth”. The question bears asking: what is a bubble and how / why do they pop? Asset bubbles are almost always the result of irresponsible usage of easy debt. When the underlying assets can no longer support the debt, prices quickly collapse. And in retrospect, we define said phenomenon as a bubble bursting.

High Tax Brain Drain & Record luxury real estate

Florida #1 for gaining high earning millennials & Miami cited by Knight Frank as the most transformative luxury real estate market, alongside Dubai & Palm Beach.

August 2024 Miami Real Estate numbers are in

August 2024 just closed out, so it is a great time to get ahead of main stream media and to report the real Miami & Miami Dade real estate numbers.

2M+ ft² of office coming to Brickell 💰

Miami news: 2M+ ft² of office coming to Brickell 💰 Coconut Grove SFH sales past $1K already up 2,200% vs 2019 full year data. Follow the money & the jobs.

Rock The Market 2024 | Ana Bozovic’s Full Presentation

Watch Ana Bozovic’s full 18 minute presentation at Rock The Market 2024, at the Hard Rock Hotel.

Miami Real Estate: The Truth Behind Inventory Levels

I am speaking at the same time day as this blog post: July 25, 2024. I will be speaking at the annual Rock The Market conference at the Hard Rock Hotel. We had well over 2,000 people attend last year, and this year is sold out again.

My topic at Rock The Market: #LongMiami & Early Times, Is There Still Room For Growth?

Short answer: the wealth migration has just begun and corroborative data keeps coming.

As I keep saying: momentum cycles are real and they build. There is no going backwards.

In the associated press this week:

“Florida’s population passes 23 million for the first time due to residents moving from other states” And it is tax payers on the move, flowing out of high tax jurisdictions that were also high lockdown.

The Wealth & Talent Migration Continues, We See The Effects In The Miami SFH Market

I am speaking at the same time day as this blog post: July 25, 2024. I will be speaking at the annual Rock The Market conference at the Hard Rock Hotel. We had well over 2,000 people attend last year, and this year is sold out again.

My topic at Rock The Market: #LongMiami & Early Times, Is There Still Room For Growth?

Short answer: the wealth migration has just begun and corroborative data keeps coming.

As I keep saying: momentum cycles are real and they build. There is no going backwards.

In the associated press this week:

“Florida’s population passes 23 million for the first time due to residents moving from other states” And it is tax payers on the move, flowing out of high tax jurisdictions that were also high lockdown.

Empire cycles, Trump and Miami Real Estate

Recent events are very much in corroboration of internal disorder predictions I have been making for a few years. I have used a certain Venn diagram in every speaking even I have had since Covid 19.

It is a powerful illustration of the three baseline forces feeding the momentum cycles we see around us now. And these momentum cycles are shaping our markets. (most notably the polarization of wealth & belief systems, both of which are fueling domestic intrastate migration).

I have had full confidence getting behind a #LongMiami thesis because it was clear to me that we are in a period of rapid change. Three forces, throughout history, have ushered in periods of rapid change. They are:

– Transformative tech adoption.

– Wars

– natural empire cycles

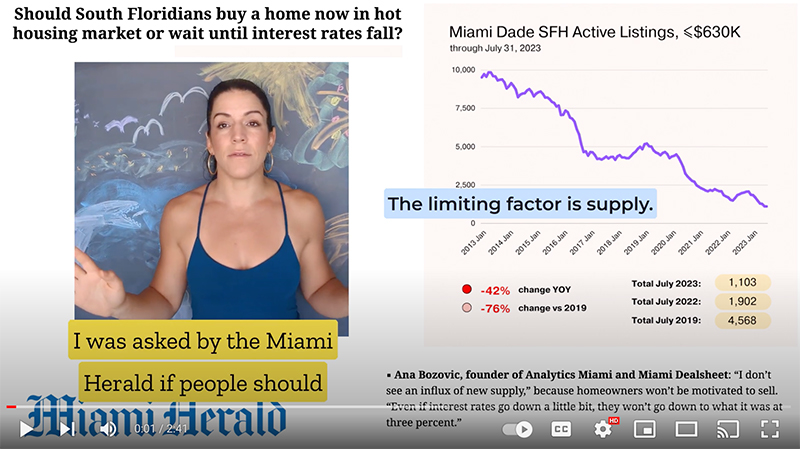

South Florida Real Estate: the truth about inventory

The Newsweek headline reads: Miami Home Prices Plunging.

The article starts by saying that “prices of homes in Miami fell by more than 11 percent last month.

That statement is false and misrepresents Realtor.com data.

I have pulled pricing and listing price data for the city of Miami, for SFH and for Condos.

SFH median prices in May 2024 were up 10% YOY, and median listing prices were up 75%.

Condo median prices in May 2024 down 1% YOY, and median listing prices were up 18% YOY.

2023 Reports and Videos

Macro Updates + Miami High end single family: best performing segment in August 2023

August numbers are in, and the prevailing trends remain strong:

1) For purposes of discussion, we have two markets: the very high and and everything else.

–> August sales volume of SFH past $1K / SF was higher than last year, despite overall volume drops. (Contact me for on & off market opportunities & buildable lots)

2) Data quantifying macro trends pushing high value domestic migrants keeps coming in.

It is my belief that forces pushing high net worth domestic migration are still in their infancy.

Miami Real Estate: new normal past $1K / square foot

There is a fundamental disconnect between supply & demand in the Miami and Miami Beach condo markets. Inventory has steadily risen across market segments, all while transaction volume has dropped off. Higher price points are the worst offenders. The Miami $1M+ market saw a 147% increase in supply since 2013, while sales dropped 32% in the same period

Whats the matter with Miami? Sorry WSJ & Krugman, what’s the matter with NYC & LA?

There is a fundamental disconnect between supply & demand in the Miami and Miami Beach condo markets. Inventory has steadily risen across market segments, all while transaction volume has dropped off. Higher price points are the worst offenders. The Miami $1M+ market saw a 147% increase in supply since 2013, while sales dropped 32% in the same period

2022 Reports and Videos

Miami real estate on fire as capital relocates, 9.5x $1M+ condo sales in Q1 2022 versus pre Covid

There is a fundamental disconnect between supply & demand in the Miami and Miami Beach condo markets. Inventory has steadily risen across market segments, all while transaction volume has dropped off. Higher price points are the worst offenders. The Miami $1M+ market saw a 147% increase in supply since 2013, while sales dropped 32% in the same period

2020 Reports and Videos

Corona Fuels Widening Wealth Gap in South Florida Real Estate

There is a fundamental disconnect between supply & demand in the Miami and Miami Beach condo markets. Inventory has steadily risen across market segments, all while transaction volume has dropped off. Higher price points are the worst offenders. The Miami $1M+ market saw a 147% increase in supply since 2013, while sales dropped 32% in the same period

Black swans, magic unicorns and fantasy land: the Miami condo market in 2020

There is a fundamental disconnect between supply & demand in the Miami and Miami Beach condo markets. Inventory has steadily risen across market segments, all while transaction volume has dropped off. Higher price points are the worst offenders. The Miami $1M+ market saw a 147% increase in supply since 2013, while sales dropped 32% in the same period

Complete Archive

2025 Q4 Miami Real Estate Market Report: Release & New Interviews

Just Released: Analytics Miami 2025 Q4 Report & Forecast Themes of the week: Wealth Migration • 2025 Q4 Report & Forecast • New Interviews Wealth migration is the theme of the week, and will be the theme of the century. Global HNWI relocations reached record levels in 2025 and still increasing into 2026. Within the United States, a clear trend persists: high value tax payers are relocating and our feeder jurisdictions are predictably increasing their hostilities to capital. The net effects of California billionaire tax are obvious. Recall that Bezos moved to Miami when his home state proposed a wealth tax. He would have accounted for 45% of the theoretical revenue. Today I read that the Netherlands is likely to start taxing unrealized capital gains at 35%. One starts to wonder what these regimes may start doing to curtain inevitable exoduses. Wealth mobility is real. Miami's emergence as a destination for wealth is evident in the year-end and Q4 numbers.

UBS Clickbait Bubbles, Rock The Market Clips & Special Invitations

Themes of the week: UBS “Bubble” Report • Rock The Market Highlights • Special Invitations. Thank you to the South Florida Business Journal for quoting me on this topic. The UBS "Bubble" report is a travesty and they should be embarrassed. This report a sensationalist misuse of a global platform, and its misleading headline is being echoed by press worldwide. * An invitation: Join me, I am speaking at the Real Deal Conference. 📍 Mana Wynwood | November 5 & 6 I am speaking on Nov 6 in a first-ever, special debate style panel with Daniel Kodsi. https://events.therealdeal.com/event/how-to-survive-the-squeeze * An invitation: Join me for my super fight at Main Character Jiu Jitsu 📍 La Scala De Miami Brickell | October 19 Tickets here, please select me at checkout: https://nitrotickets.com/event/1064/MCJJ-1HALLOWEEN-1HAVOC-1--11019

September 2025 Miami Real Estate update: Fed rate cuts & Ana Bozovic on Fox News Live

The Federal Reserve just cut rates by 25 basis points, with Powell signaling that two more rate cuts are possible by the end of the year. What does this mean for Miami real estate? The net effect of this will be an increase of monetary flow into the market. Meaning: more money and participants will enter the Miami market. Watch Ana Bozovic's Fox News segments where she touches upon the future of Miami real estate and what is driving the flow of money to the region.

Q2 2025 Miami Dade Real Estate Report & Ana Bozovic Speaking at Inman Miami

I hope you enjoy the release of my Q2 2025 Miami Dade Real Estate Report. This post also includes video segments of Ana Bozovic's Inman Connect 2025 talk at New World Symphony in Miami Beach. The segments will help to contextualize and bring to life the Q2 2025 market report.

Q1 2025 Miami Dade Real Estate Report

Thank you Peter Santanello for shooting an episode with me:Inside Wealthy Miami – Why Are So Many Americans Moving Here? Thank you Wall Street Journal for using my data and quoting me in this excellent article: Million-Dollar Homes Skyrocket in Miami, as Starter Properties Go Extinct.

Miami Dade Real Estate: March 2025 Update

Thank you Peter Santanello for shooting an episode with me:Inside Wealthy Miami – Why Are So Many Americans Moving Here? Thank you Wall Street Journal for using my data and quoting me in this excellent article: Million-Dollar Homes Skyrocket in Miami, as Starter Properties Go Extinct.

Miami Dade Real Estate: January 2025 Update

January has closed out in Miami. How are the markets behaving so far in 2025? The tail of two markets continues to play out. -> sales volume of both SFH & Condos past $2K / square foot are up year-over-year, clocking in record transaction volume for the month of January. In Jan 2019, there were ZERO SFH sales past $2K / sq ft. Things can change quickly. New product at prime locations (especially end user product) is likely in under supply. -> the extinction of SFH below $500K continues. Active listings (inventory) in Miami Dade < $500K in January 2025: 640. Active listings (inventory) in Miami Dade <$500K in January 2019: 4,452 We are down 86% vs. pre Covid in 2019. This is the extinction of a price point.

Just released: Miami Dade 2024 annual report & 2025 forecast!

Just released! My 2024 annual Miami Dade real estate report is now live! Uncover Miami's hottest real estate trends & opportunities. Highlights: --> New product at prime locations continues to shine: we actually don’t have enough. Both condo and SFH transaction volume was up YOY past $1K / sq ft. SFH past $1K /sq ft hit an all time high and is up a remarkable 631% vs. 2019 (pre Covid) --> Despite fake, alarmist press headlines: Miami Dade overall inventory levels remain below 2019 (pre Covid) levels --> Speaking of inventory levels, this is truly shocking: Miami Dade SFH active listings below $500K are down 800% vs. 2019 pre covid. There are now only about 600 active SFH listings sub $500K in all of Miami Dade County. Pre Covid in 2019, there were over 3,500. I think the implications of this are obvious. And far reaching.

Hot off the presses! Miami Dade SFH 2024 report preview

Hot off the presses! Miami Dade SFH 2024 report preview. Full 2024 year end report and 2025 forecast coming next week. Median price at all time highs, inventory 36% below pre covid (2019). This should provide plenty of ammo to retort the negative, click bait generated by legacy media. Annual data is simple to understand and the truth is clear.

NEW CENSUS DATA: blue states continue to lose population!

I made the table after downloading and processing newly released 2023 interstate census data. Source: https://www.census.gov/newsroom/press-releases/2024/state-to-state-migration-flows.html The pattern is very clear. High tax, blue states are losing population due to interstate migration. And as I keep saying, I do not see this reversing. I do not see a sudden net flow into high tax states. The political leanings of the state seem to be correlated to the tax levels. My study was picked up twice by the Daily Mail. https://www.dailymail.co.uk/news/article-14055047/US-map-fastest-growing-states-census-population.html https://www.dailymail.co.uk/yourmoney/article-14198061/florida-arizona-cities-baby-boomers-travel-packs.html The pattern is very clear. As the country reshapes around 21st century realities and shift in economic focus continues, high tax states are clearly losing population.

Ana Bozovic Refutes Newsweek, yet again

Legacy media has dug its own grave. Completely false headline again, accompanied by a very poorly written story. The arrogance with which legacy media lies and creates poorly written, politically motivated hit pieces is breath taking. And this is my second time refuting a Newsweek article. I had previously debunked a Newsweek article in July, 2024.

Trump won. What does this mean for Florida & Miami real estate?

Trump won the election, what does that mean for South Florida & Miami real estate? Journalist Brian Bandel asked me that question the day after the election. And this is what I told the South Florida Business Journal: “Given the team that he has assembled, most notably Elon Musk, I believe that a Trump presidency will be aligned with entrepreneurs and creators,” Bozovic said. “Since South Florida is attracting tax payers and creators, our housing market will be further super charged by an administration that fosters entrepreneurship.” And I stand by every word of that. Furthermore, I feel that a subconscious pause has been lifted in the aftermath of the election. The next wave forward is about to commence. And note: I am compiling October numbers. As per my thesis, the SFH market continues to hit all time highs. End user product within proximity of the urban core is a strong play.

2023 Intrastate Migration Numbers Released by the Census: TX & FL winning

2023 Intrastate migration numbers are in, just released at census.gov. Rather unsurprisingly, the post Covid trend continues. TX & Florida are once again #1 & #2 when it comes to net intrastate migration gains. * Blue states, that tended to be high lock-down & are high-tax, keep losing population. (This is an observation, I am a registered independent). The top five population losers were all blue states.The two winners (TX & FL) have no state income tax. The two biggest two losers (CA & NY) have among the highest levels. I do not report on this with any personal joy, I grew up in NYC. It is what it is.

Ana Bozovic Debunks Business Insider

I released my official Q3 2024 Miami Dade report last week. All of the Miami and South Florida numbers were fresh in mind. I happened to come across an article in Business Insider that made the bold statement: "Home-listing prices are down as much as 12% in boomtowns in Florida, Texas, and other popular states" The article then lists Miami as #1, with a 12% drop in list prices. This is absolutely not true. Not even close. This is honestly mind-blowing. I caught this because I am an expert in this field. And in all honestly, this makes me seriously wonder what else is completely false.

Q3 2024 Miami Dade Real Estate Report: Official Release

Officially live: Ana Bozovic's Q3 2024 Miami Dade Real Estate report! Segments catering to the wealth and talent migration continue to outperform pre Covid realities by a wide margin, with some segments at all time highs. Ex: SFH past $1K /sq ft transacted at record levels Q1-Q3 of 2024. And most market segments above $500K saw YOY sales volume growth (all SFH segments and some condo). Actionable value is found when drilling down, but the macro drives the micro. We need to understand the basis of the market and the fundamental trends driving what we see in the numbers. Starting there, we can then drill down further in order to make predictions on specific sectors.

Q3 2024 Miami Real Estate Report Preview

Q3 2024 has just closed out! The data continues to trickle in. I will have my full Q3 report ready for you next week. Today I would like to share a preview of some of the initial findings. Spoiler alert: the #LongMiami and South Florida thesis keeps playing out. Segments successfully catering to the wealth & talent migration: -> New product in prime location. -> Throw in in inherent scarcity, and you get the phenomenon that is our high-end SFH market.

Show Me The Money: all cash buying percentages across South Florida real estate

Show Me The Money: A cash market is very unlikely to exhibit bubble-like behavior and it has a solid floor. The South Florida market is very heavy on cash. As data keeps coming in corroborating the South Florida & Miami story, various news outlets continue to publish unsubstantiated clickbait to the contrary. I have been seeing stories lately about "bubbles" and "froth". The question bears asking: what is a bubble and how / why do they pop? Asset bubbles are almost always the result of irresponsible usage of easy debt. When the underlying assets can no longer support the debt, prices quickly collapse. And in retrospect, we define said phenomenon as a bubble bursting.

High Tax Brain Drain & Record luxury real estate

Florida #1 for gaining high earning millennials & Miami cited by Knight Frank as the most transformative luxury real estate market, alongside Dubai & Palm Beach.

August 2024 Miami Real Estate numbers are in

August 2024 just closed out, so it is a great time to get ahead of main stream media and to report the real Miami & Miami Dade real estate numbers.

2M+ ft² of office coming to Brickell 💰

Miami news: 2M+ ft² of office coming to Brickell 💰 Coconut Grove SFH sales past $1K already up 2,200% vs 2019 full year data. Follow the money & the jobs.

Rock The Market 2024 | Ana Bozovic’s Full Presentation

Watch Ana Bozovic's full 18 minute presentation at Rock The Market 2024, at the Hard Rock Hotel.

Miami Real Estate: The Truth Behind Inventory Levels

I am speaking at the same time day as this blog post: July 25, 2024. I will be speaking at the annual Rock The Market conference at the Hard Rock Hotel. We had well over 2,000 people attend last year, and this year is sold out again. My topic at Rock The Market: #LongMiami & Early Times, Is There Still Room For Growth? Short answer: the wealth migration has just begun and corroborative data keeps coming. As I keep saying: momentum cycles are real and they build. There is no going backwards. In the associated press this week: "Florida’s population passes 23 million for the first time due to residents moving from other states" And it is tax payers on the move, flowing out of high tax jurisdictions that were also high lockdown.

The Wealth & Talent Migration Continues, We See The Effects In The Miami SFH Market

I am speaking at the same time day as this blog post: July 25, 2024. I will be speaking at the annual Rock The Market conference at the Hard Rock Hotel. We had well over 2,000 people attend last year, and this year is sold out again. My topic at Rock The Market: #LongMiami & Early Times, Is There Still Room For Growth? Short answer: the wealth migration has just begun and corroborative data keeps coming. As I keep saying: momentum cycles are real and they build. There is no going backwards. In the associated press this week: "Florida’s population passes 23 million for the first time due to residents moving from other states" And it is tax payers on the move, flowing out of high tax jurisdictions that were also high lockdown.

Empire cycles, Trump and Miami Real Estate

Recent events are very much in corroboration of internal disorder predictions I have been making for a few years. I have used a certain Venn diagram in every speaking even I have had since Covid 19. It is a powerful illustration of the three baseline forces feeding the momentum cycles we see around us now. And these momentum cycles are shaping our markets. (most notably the polarization of wealth & belief systems, both of which are fueling domestic intrastate migration). I have had full confidence getting behind a #LongMiami thesis because it was clear to me that we are in a period of rapid change. Three forces, throughout history, have ushered in periods of rapid change. They are: - Transformative tech adoption. - Wars - natural empire cycles

South Florida Real Estate: the truth about inventory

The Newsweek headline reads: Miami Home Prices Plunging. The article starts by saying that "prices of homes in Miami fell by more than 11 percent last month. That statement is false and misrepresents Realtor.com data. I have pulled pricing and listing price data for the city of Miami, for SFH and for Condos. SFH median prices in May 2024 were up 10% YOY, and median listing prices were up 75%. Condo median prices in May 2024 down 1% YOY, and median listing prices were up 18% YOY.

Newsweek Rebuttal: Miami Home Prices Are Absolutely Not Plunging

The Newsweek headline reads: Miami Home Prices Plunging. The article starts by saying that "prices of homes in Miami fell by more than 11 percent last month. That statement is false and misrepresents Realtor.com data. I have pulled pricing and listing price data for the city of Miami, for SFH and for Condos. SFH median prices in May 2024 were up 10% YOY, and median listing prices were up 75%. Condo median prices in May 2024 down 1% YOY, and median listing prices were up 18% YOY.

Macro Updates + Miami High end single family: best performing segment in August 2023

August numbers are in, and the prevailing trends remain strong: 1) For purposes of discussion, we have two markets: the very high and and everything else. --> August sales volume of SFH past $1K / SF was higher than last year, despite overall volume drops. (Contact me for on & off market opportunities & buildable lots) 2) Data quantifying macro trends pushing high value domestic migrants keeps coming in. It is my belief that forces pushing high net worth domestic migration are still in their infancy.

Miami Real Estate: new normal past $1K / square foot

There is a fundamental disconnect between supply & demand in the Miami and Miami Beach condo markets. Inventory has steadily risen across market segments, all while transaction volume has dropped off. Higher price points are the worst offenders. The Miami $1M+ market saw a 147% increase in supply since 2013, while sales dropped 32% in the same period

Whats the matter with Miami? Sorry WSJ & Krugman, what’s the matter with NYC & LA?

There is a fundamental disconnect between supply & demand in the Miami and Miami Beach condo markets. Inventory has steadily risen across market segments, all while transaction volume has dropped off. Higher price points are the worst offenders. The Miami $1M+ market saw a 147% increase in supply since 2013, while sales dropped 32% in the same period

Miami real estate on fire as capital relocates, 9.5x $1M+ condo sales in Q1 2022 versus pre Covid

There is a fundamental disconnect between supply & demand in the Miami and Miami Beach condo markets. Inventory has steadily risen across market segments, all while transaction volume has dropped off. Higher price points are the worst offenders. The Miami $1M+ market saw a 147% increase in supply since 2013, while sales dropped 32% in the same period

Corona Fuels Widening Wealth Gap in South Florida Real Estate

There is a fundamental disconnect between supply & demand in the Miami and Miami Beach condo markets. Inventory has steadily risen across market segments, all while transaction volume has dropped off. Higher price points are the worst offenders. The Miami $1M+ market saw a 147% increase in supply since 2013, while sales dropped 32% in the same period

Black swans, magic unicorns and fantasy land: the Miami condo market in 2020

There is a fundamental disconnect between supply & demand in the Miami and Miami Beach condo markets. Inventory has steadily risen across market segments, all while transaction volume has dropped off. Higher price points are the worst offenders. The Miami $1M+ market saw a 147% increase in supply since 2013, while sales dropped 32% in the same period

Q3 2019 Supply & Demand Report: Miami Condos & Miami Beach Condos

There is a fundamental disconnect between supply & demand in the Miami and Miami Beach condo markets. Inventory has steadily risen across market segments, all while transaction volume has dropped off. Higher price points are the worst offenders. The Miami $1M+ market saw a 147% increase in supply since 2013, while sales dropped 32% in the same period

Q2 2018 Miami Beach Condos: Records $3M+ Sales, Luxury Condos at 2013 Prices

Q2 2018 saw a record number of $3M+ condo transactions in Miami Beach. After years of declining sales volume, sellers are starting to meet buyers. The oceanfront luxury condo market is starting to clear at 2013 prices, and high profile hedge fund managers are leading the way.

Miami Beach Top 10 Condo Sales – Q1 & Q2 2018

2018 Q1 & Q2: The top 10 Miami Beach condo sales ranged from $8.7M - $26M. The second quarter saw a record number of $3M+ sales, as buyers negotiated significant discounts. The top ten sales averages a 29% discount off of their original list price and took an average of 503 days to sell. Post has interactive map and table.

South Beach shines, Flamingo historic district disappoints

There is an ongoing debate over the value of preservation and historic districts. What has been lacking in this discussion…

Miami Condo Bubble: The cash buyer is disappearing

The early 2000s Miami boom was fueled by liar loans, but this cycle was fueled by the cash buyer. Miami Beach condo transactions have declined sharply for 4 straight years. 91% of the decline is due to the disappearance of the cash buyer from the Miami real estate market. Meanwhile, debt is getting more expensive.

Miami Beach: Historic Preservation is Driving Out the Middle Class

Miami Beach's older housing stock never recovered from the last market downturn. "Historic" 1950s and 1960s buildings are being passed…

Miami Beach is losing rental buildings while demand is growing

The supply of Miami Beach multi family properties has declined by over 15% since 2010, while demand is increasing. Spotlight on North Beach: the neighborhood is in early sages of revitalization. Real estate opportunity: take advantage of under-supply in Miami multi family + neighborhood upside.

In The Press: South Florida Business Journal, North Beach Opportunities & Obstacles

Thank you South Florida Business Journal for giving me the opportunity to contribute to the discussion on Miami Beach development…

Special Real Estate Report: Miami Condo Inventory

Contact me for: off-market hotel deals, land deals and hotel marketing. I have one of the largest private databases on…

Analytics Miami Condo Market Report – State of the Market 2018

Contact me for: off-market hotel deals, land deals and hotel marketing. I have one of the largest private databases on…

Map of the Miami’s Micro Apartment and Condo Projects

1. Vice Tower --> renamed, xMiami Address: 230 NE 4th St, Miami, FL Status: topped off, June 2017 Completion: Fall, 2018…

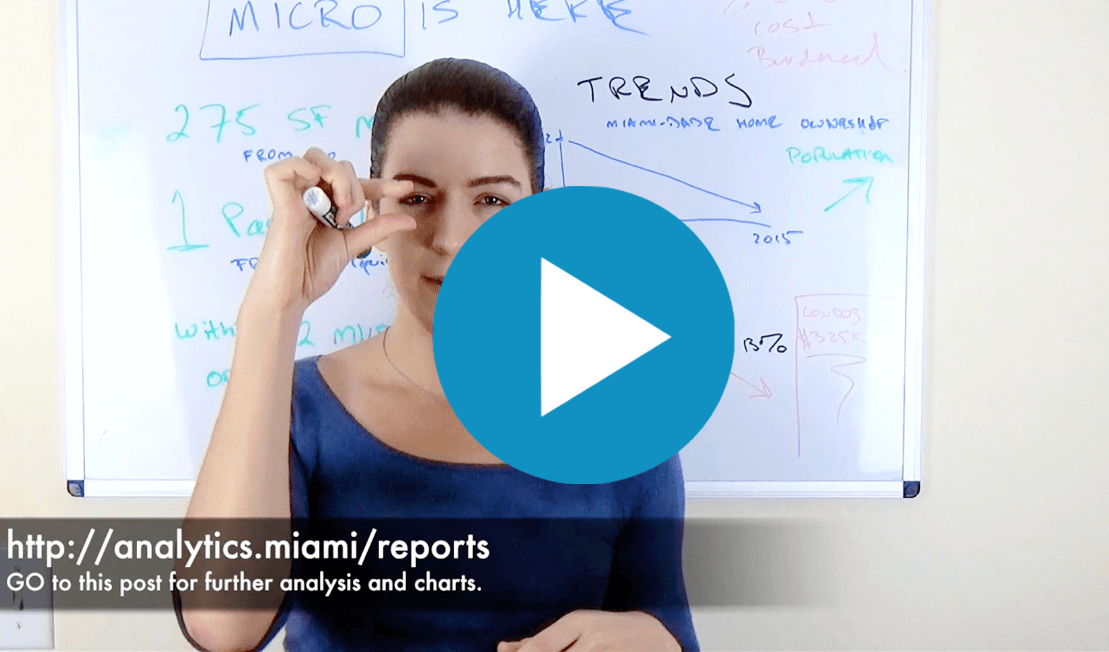

Micro Units Coming to the Miami Real Estate Market

Key Points on new Micro Designation: Minimum residential unit size reduced to 275 SF from 400 SF. Can only…

Great News for Miami Hotels: Miami is the Second Most Visited City in the Americas

Miami ranks only behind NYC for incoming international visitors. According to Euromonitor's recently released Top 100 City Destination Ranking study,…

Map of the 5 Most Expensive Per Room Miami Hotel Sales

1. Ritz Carlton Key Biscayne Address: 455 Grand Bay Drive Sold: $325M in 2015 = $1,069,536 /key Largest transaction of 2015…

Miami Hotel Market – where are the opportunities?

The Miami hotel market is one of the best in the nation. The Miami hotel market has shown strong and…

Miami Hotel Market Report: Long Term Trends, through Summer 2017

Going back to 1987, the Miami hotel market has exhibited strong and steady growth across key metrics, exhibiting less volatility…

Miami Real Estate Report Q2 2017: Condo & SFH Macro Overviews

I am very happy to announce the first of my official Miami real estate reports. These first Miami real estate…

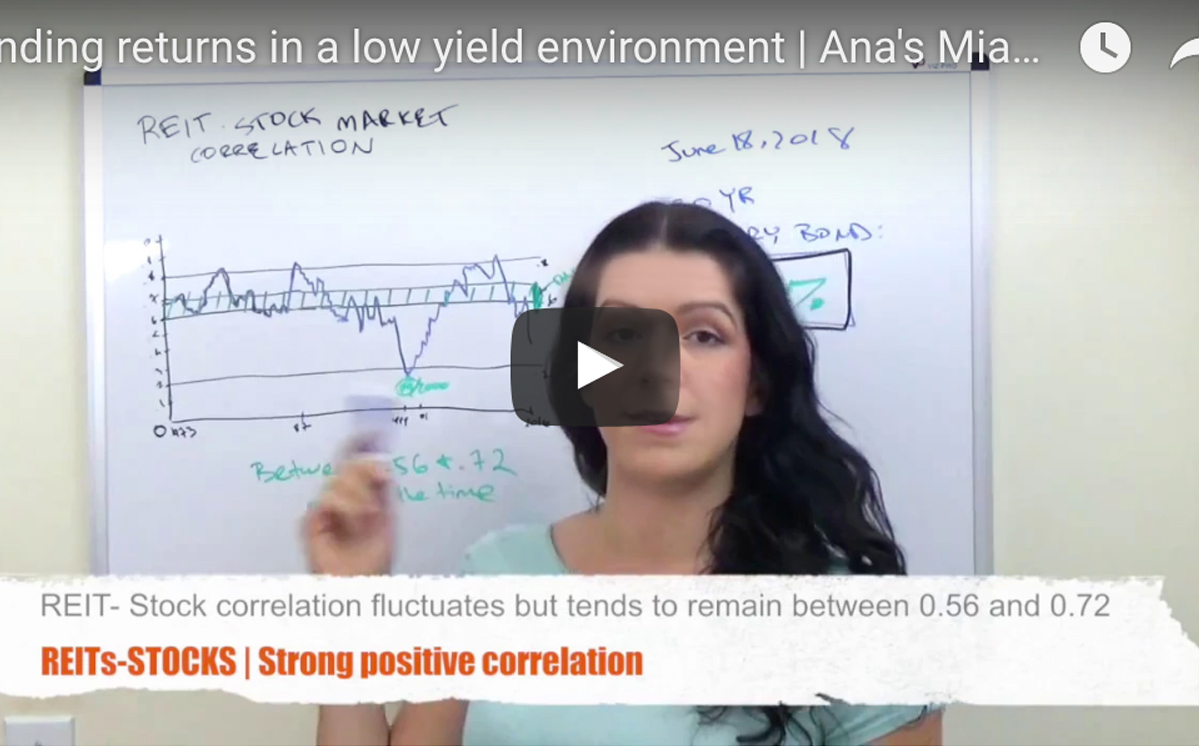

Real Estate Investing: Finding Returns In A Low Yield Environment

Questions I often get asked by individual investors: Where should I put my money? Where can I get a good return?…

Neighborhood Spotlight: Miami Beach Condo Market

Miami Beach is a municipality located on barrier islands that are separated from the mainland by Biscayne Bay. With its Caribbean…

Where is the bubble in Miami Condos? These charts reveal the truth.

To understand where forces are pushing the Miami real estate market, it is important to know the current relationships between the…

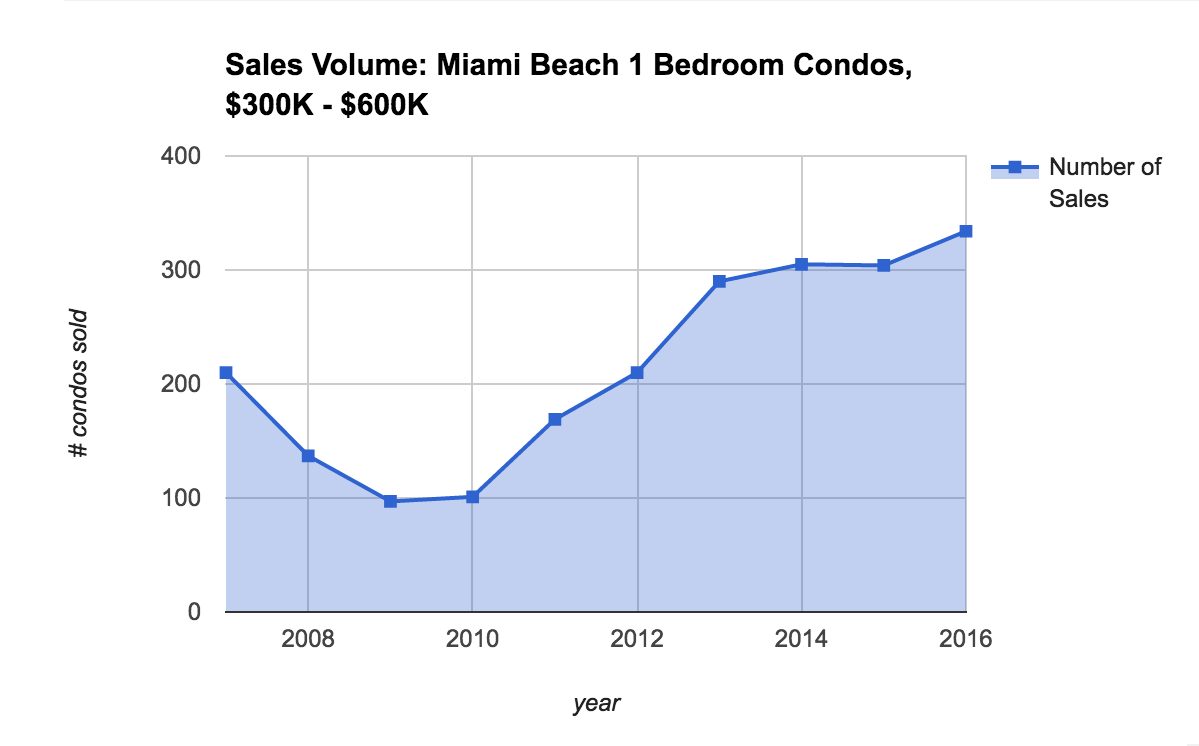

Market Winners: Miami Beach One Bedroom Condos

The general Miami condo market is experiencing drastic reductions in transaction volume. We are currently below 2011 volume. However, there…

Miami Condo Sales: The General Market Never Got Back to Old Highs

Here's a fact about the Miami condo market that surprises many people: neither median nor average condo prices ever got back to…

Miami Condo Sales Volume 2007 – 2017 | Real Estate Trend Analysis

There has been quite a lot of talk in the press lately about Miami condo inventory, both incoming and active…